Technological Advancements

The Silver Market is experiencing a notable transformation due to rapid technological advancements. Innovations in mining techniques and refining processes have led to increased efficiency and reduced costs. For instance, the adoption of automated systems in mining operations has improved yield rates, allowing for more silver to be extracted with less environmental impact. Furthermore, advancements in silver applications, particularly in electronics and renewable energy sectors, are driving demand. The integration of silver in photovoltaic cells for solar panels is particularly noteworthy, as it enhances energy conversion efficiency. As these technologies evolve, they are likely to create new opportunities within the Silver Market, potentially leading to increased consumption and investment.

Jewelry and Silverware Demand

The demand for silver in the jewelry and silverware segments remains a crucial driver for the Silver Market. In recent years, there has been a resurgence in consumer interest in silver jewelry, attributed to changing fashion trends and the growing popularity of artisanal and handcrafted items. According to recent data, the jewelry sector accounts for a substantial portion of silver consumption, with estimates suggesting it represents around 30% of total demand. Additionally, the rise of e-commerce platforms has facilitated access to silver products, further boosting sales. This trend indicates a robust market for silver jewelry price, which may continue to expand as consumers seek unique and sustainable options.

Investment Demand and Market Sentiment

Investment demand plays a pivotal role in shaping the Silver Market outlook. As investors seek to diversify their portfolios, silver is often viewed as a safe-haven asset, particularly during periods of economic uncertainty. Recent trends indicate that silver exchange-traded funds (ETFs) have seen increased inflows, reflecting a growing interest among investors. In 2025, the total holdings in silver ETFs reached record levels, suggesting a strong bullish sentiment towards silver as a long-term investment. This trend is likely to continue, as investors may perceive silver as a hedge against inflation and currency fluctuations, thereby driving demand in the Silver Market.

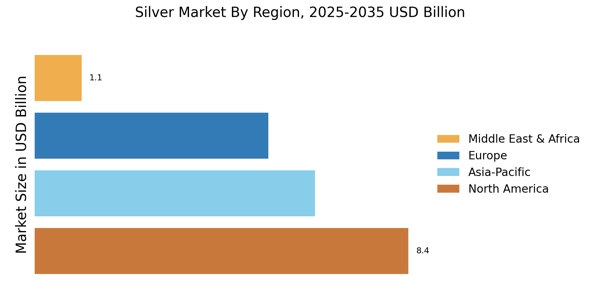

Geopolitical Factors and Supply Chain Dynamics

Geopolitical factors significantly impact the Silver Market, influencing both supply and demand dynamics. Political instability in key silver-producing regions can lead to supply disruptions, affecting global silver price. For example, recent tensions in South America, a major silver mining area, have raised concerns about potential output reductions. Additionally, trade policies and tariffs can alter the flow of silver across borders, impacting market accessibility. As nations navigate complex geopolitical landscapes, the Silver Market may experience fluctuations in supply and demand, prompting investors and businesses to adapt their strategies accordingly. This interplay of geopolitical factors is likely to remain a critical driver in the evolving landscape of the silver market.

Industrial Applications and Technological Integration

The Silver Market value is significantly influenced by its diverse industrial applications. Silver Market's unique properties, such as high electrical conductivity and antibacterial characteristics, make it indispensable in various sectors, including electronics, healthcare, and automotive industries. For instance, the use of silver in conductive inks and coatings for electronic devices is on the rise, driven by the increasing demand for smart technologies. Additionally, the healthcare sector utilizes silver in wound dressings and medical devices, enhancing patient care. As industries continue to innovate and integrate silver into new applications, the demand for silver is expected to grow, further solidifying its position in the Silver Market.