Market Growth Projections

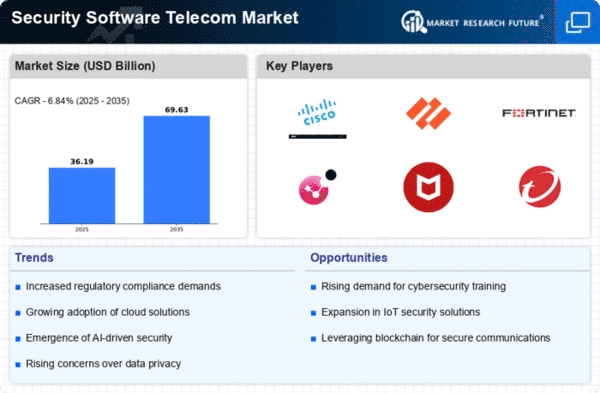

The Global Security Software in Telecom Market Industry is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of 6.84% from 2025 to 2035. This growth trajectory is driven by the increasing complexity of cyber threats, regulatory pressures, and the ongoing digital transformation within the telecom sector. As companies prioritize cybersecurity investments, the market is expected to expand significantly, reflecting the critical importance of securing telecom infrastructures in an increasingly interconnected world.

Growing Demand for IoT Security

The proliferation of Internet of Things (IoT) devices presents unique security challenges for the Global Security Software in Telecom Market Industry. As telecom operators expand their service offerings to include IoT solutions, the need for specialized security software becomes paramount. Protecting interconnected devices from cyber threats is critical to maintaining customer trust and ensuring service reliability. Consequently, telecom companies are investing in advanced security measures tailored to IoT environments, driving growth in the market as they seek to safeguard their networks and customers.

Increasing Cybersecurity Threats

The Global Security Software in Telecom Market Industry is experiencing heightened demand due to the escalating frequency and sophistication of cyber threats. Telecom operators are increasingly targeted by malicious actors seeking to exploit vulnerabilities in networks. For instance, the rise in ransomware attacks has prompted telecom companies to invest heavily in security software solutions. As a result, the market is projected to reach 33.9 USD Billion in 2024, reflecting a growing recognition of the need for robust cybersecurity measures to protect sensitive customer data and maintain operational integrity.

Adoption of Cloud-Based Solutions

The shift towards cloud computing is transforming the Global Security Software in Telecom Market Industry. Telecom operators are increasingly migrating their operations to cloud platforms, necessitating advanced security measures to protect data in transit and at rest. Cloud-based security solutions offer scalability and flexibility, enabling telecom companies to respond swiftly to emerging threats. This trend is anticipated to drive significant growth in the market, as organizations seek to leverage the benefits of cloud technology while ensuring robust security protocols are in place.

Regulatory Compliance Requirements

Regulatory frameworks are becoming more stringent, compelling telecom companies to adopt comprehensive security software solutions. The Global Security Software in Telecom Market Industry is influenced by regulations such as the General Data Protection Regulation (GDPR) and the Telecommunications Act, which mandate stringent data protection measures. Compliance with these regulations not only safeguards customer information but also mitigates the risk of hefty fines. As telecom operators navigate these complex regulatory landscapes, the demand for security software is expected to surge, contributing to the market's growth trajectory.

Integration of AI and Machine Learning

The integration of artificial intelligence and machine learning technologies into security software is revolutionizing the Global Security Software in Telecom Market Industry. These technologies enhance threat detection and response capabilities, enabling telecom operators to proactively identify and mitigate potential risks. AI-driven solutions can analyze vast amounts of data in real-time, providing actionable insights that improve overall security posture. As the industry continues to evolve, the adoption of AI and machine learning is likely to be a key driver of market growth, with projections indicating a market size of 70.2 USD Billion by 2035.