Shift Towards Remote Work

The UK security software telecom market is witnessing a notable shift towards remote work, which has implications for security software demand. As organizations adapt to flexible work arrangements, the need for secure remote access to corporate networks has become paramount. This shift has led to an increased reliance on security solutions that facilitate secure connections and protect against potential vulnerabilities associated with remote access. Data indicates that a significant percentage of UK employees are now working remotely, prompting businesses to invest in security software that can effectively safeguard remote operations. Consequently, the demand for solutions such as Virtual Private Networks (VPNs) and endpoint security software is likely to grow, reflecting the evolving landscape of work in the UK.

Rising Cybersecurity Threats

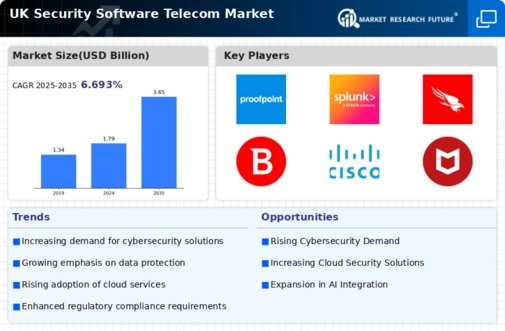

The UK security software telecom market is currently experiencing a surge in cybersecurity threats, which appears to be driving demand for robust security solutions. With the increasing sophistication of cyberattacks, organizations are compelled to invest in advanced security software to protect sensitive data and maintain operational integrity. According to recent data, the UK has seen a notable rise in reported cyber incidents, prompting businesses to prioritize cybersecurity measures. This trend indicates a growing recognition of the importance of safeguarding digital assets, thereby fueling the growth of the security software telecom market. As companies seek to mitigate risks associated with data breaches and cyber threats, the demand for innovative security solutions is likely to continue its upward trajectory.

Regulatory Compliance Requirements

The UK security software telecom market is significantly influenced by stringent regulatory compliance requirements. Organizations are increasingly required to adhere to various data protection regulations, such as the General Data Protection Regulation (GDPR) and the Data Protection Act. These regulations necessitate the implementation of comprehensive security measures to protect personal data and ensure compliance. As a result, businesses are investing in security software solutions that not only meet regulatory standards but also enhance their overall security posture. The potential for hefty fines and reputational damage associated with non-compliance further drives the demand for security solutions within the telecom sector. This regulatory landscape is likely to continue shaping the market, as organizations strive to align their security practices with evolving legal requirements.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into security software is emerging as a key driver in the UK security software telecom market. AI technologies are being leveraged to enhance threat detection, automate responses, and improve overall security efficiency. The ability of AI to analyze vast amounts of data in real-time allows organizations to identify potential threats more swiftly and accurately. As cyber threats become increasingly complex, the adoption of AI-driven security solutions appears to be a strategic move for businesses seeking to bolster their defenses. The market is likely to see a rise in AI-powered security tools, as organizations recognize the potential benefits of incorporating advanced technologies into their security frameworks.

Increased Investment in Digital Transformation

The UK security software telecom market is experiencing increased investment in digital transformation initiatives, which is driving demand for security solutions. As organizations transition to digital platforms and cloud-based services, the need for robust security measures becomes more pronounced. This digital shift necessitates the implementation of security software that can protect against emerging threats and vulnerabilities associated with digital environments. Data suggests that a significant portion of UK businesses are prioritizing digital transformation, leading to a corresponding rise in the adoption of security solutions. This trend indicates a growing awareness of the importance of integrating security into digital strategies, thereby propelling the growth of the security software telecom market.