Market Growth Projections

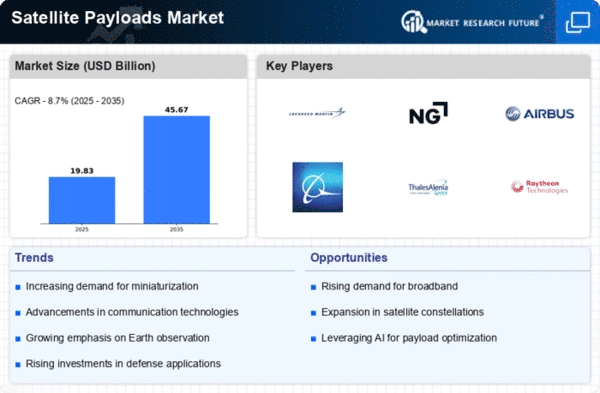

The Global Satellite Payloads Industry is projected to experience substantial growth in the coming years. With a market valuation of 18.2 USD Billion in 2024, it is anticipated to reach 45.7 USD Billion by 2035, reflecting a compound annual growth rate of 8.7% from 2025 to 2035. This growth is driven by various factors, including advancements in satellite technology, increasing demand for communication and Earth observation applications, and government investments in space programs. As the industry evolves, stakeholders are likely to adapt to emerging trends and technologies, ensuring a competitive landscape that fosters innovation and expansion. The market's trajectory suggests a promising future for satellite payloads.

Government Investments in Space Programs

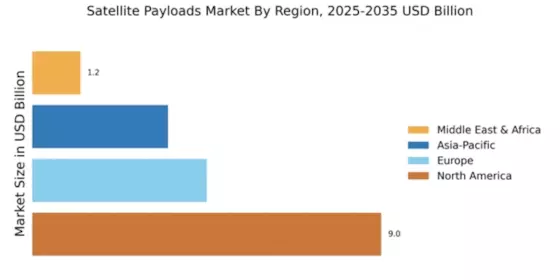

Government investments in space programs significantly influence the Global Satellite Payloads Industry. Many nations are prioritizing space exploration and satellite technology as part of their strategic initiatives. Increased funding for satellite development projects, including national security and scientific research, indicates a commitment to advancing satellite capabilities. For instance, the United States and several European countries are expanding their satellite constellations to enhance global surveillance and communication. This trend is likely to stimulate market growth, as government contracts often lead to substantial revenue for satellite payload manufacturers. The anticipated compound annual growth rate of 8.7% from 2025 to 2035 underscores the potential for expansion in this sector.

Emergence of Small Satellite Technologies

The emergence of small satellite technologies is reshaping the Global Satellite Payloads Industry. Small satellites, or CubeSats, offer cost-effective solutions for various applications, including scientific research and commercial services. Their compact size and reduced launch costs make them attractive for startups and established companies alike. This trend is likely to democratize access to space, enabling a broader range of stakeholders to participate in satellite missions. As the technology matures, small satellites are expected to play a crucial role in Earth observation, communication, and technology demonstration. The growing interest in small satellite payloads suggests a shift in market dynamics, potentially leading to increased competition and innovation.

Rising Demand for Remote Sensing Applications

The Global Satellite Payloads Industry is witnessing a surge in demand for remote sensing applications across various sectors, including agriculture, forestry, and urban planning. Satellite payloads equipped with advanced sensors provide critical data for monitoring crop health, land use, and environmental changes. This demand is driven by the increasing need for sustainable practices and efficient resource management. As industries recognize the value of satellite data in decision-making processes, investments in remote sensing technologies are likely to grow. The integration of multispectral and hyperspectral imaging capabilities enhances the accuracy of data collected, further driving market expansion. This trend indicates a promising future for satellite payloads in supporting global sustainability efforts.

Advancements in Earth Observation Technologies

Technological advancements in Earth observation payloads are reshaping the Global Satellite Payloads Industry. Enhanced imaging capabilities and data analytics are enabling more precise monitoring of environmental changes, urban development, and disaster management. Governments and organizations are increasingly utilizing satellite data for climate research and resource management, which suggests a growing market potential. The integration of artificial intelligence and machine learning in satellite payloads enhances data processing efficiency, allowing for real-time analysis. This trend is expected to contribute to the market's growth, as the demand for accurate and timely information continues to rise, potentially leading to a market valuation of 45.7 USD Billion by 2035.

Increasing Demand for Communication Satellites

The Global Satellite Payloads Industry experiences a robust demand for communication satellites, driven by the growing need for high-speed internet and mobile connectivity. As of 2024, the market is valued at approximately 18.2 USD Billion, reflecting the increasing reliance on satellite technology for communication purposes. The expansion of 5G networks and the rise of Internet of Things (IoT) applications further amplify this demand. Companies are investing in advanced payload technologies to enhance data transmission capabilities, which is likely to propel the market forward. This trend indicates a significant shift towards satellite-based communication solutions, which are essential for global connectivity.