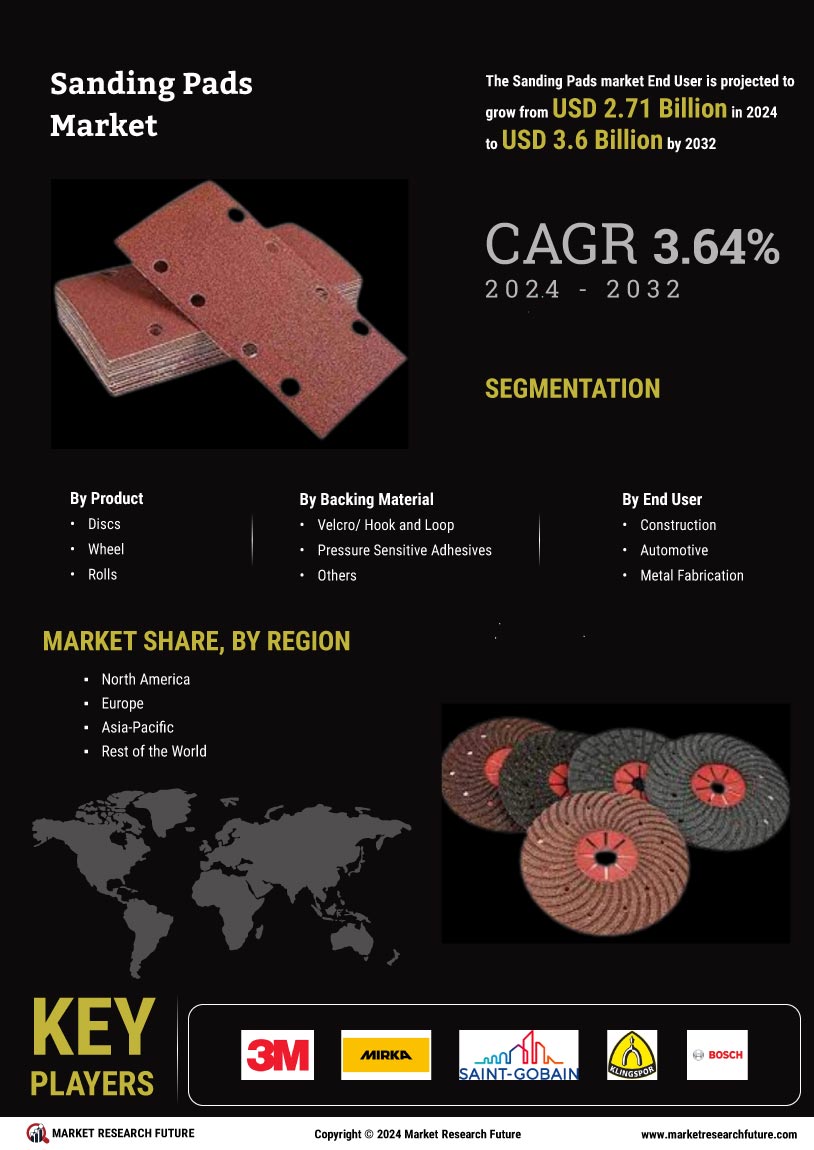

Growth in Automotive Industry

The Sanding Pads Market is significantly impacted by the growth of the automotive sector. As vehicle production ramps up, the demand for sanding pads is expected to rise correspondingly. In 2025, the automotive industry is anticipated to witness a growth rate of around 4%, which will likely lead to increased usage of sanding pads for surface finishing and refinishing applications. These pads are crucial for preparing surfaces for painting and coating, ensuring that vehicles meet stringent quality standards. Additionally, the trend towards electric vehicles may further drive innovation in sanding pad technology, as manufacturers seek to optimize production processes. This evolving landscape suggests that the sanding pads market will continue to benefit from advancements in automotive manufacturing and design.

Expansion of E-commerce Platforms

The Sanding Pads Market is experiencing a transformation due to the expansion of e-commerce platforms. As online shopping becomes increasingly prevalent, consumers are more inclined to purchase sanding pads through digital channels. In 2025, it is projected that e-commerce sales in the home improvement sector will grow by approximately 7%, facilitating greater access to a variety of sanding products. This shift not only enhances convenience for consumers but also allows manufacturers to reach a broader audience. Furthermore, the availability of detailed product information and customer reviews online aids consumers in making informed purchasing decisions. As e-commerce continues to reshape the retail landscape, the sanding pads market is likely to benefit from increased visibility and sales opportunities.

Increasing Demand in Construction Sector

The Sanding Pads Market is experiencing a notable surge in demand, primarily driven by the expansion of the construction sector. As urbanization accelerates, the need for high-quality finishing materials has become paramount. In 2025, the construction industry is projected to grow at a compound annual growth rate of approximately 5.5%, which directly influences the consumption of sanding pads. These products are essential for achieving smooth surfaces on various materials, including wood and metal, thereby enhancing the overall aesthetic and durability of construction projects. Furthermore, the rise in residential and commercial building projects necessitates the use of sanding pads, as they are integral to surface preparation and finishing processes. This trend indicates a robust future for the sanding pads market, as construction activities continue to flourish.

Technological Innovations in Sanding Pads

Technological advancements are playing a pivotal role in shaping the Sanding Pads Market. Innovations in materials and manufacturing processes are leading to the development of more efficient and durable sanding pads. For instance, the introduction of advanced abrasives and backing materials enhances the performance and lifespan of these products. In 2025, it is estimated that the market for high-performance sanding pads will grow by approximately 6%, driven by the demand for superior finishing solutions across various industries. These innovations not only improve the effectiveness of sanding pads but also contribute to sustainability efforts by reducing waste and increasing product longevity. As manufacturers continue to invest in research and development, the sanding pads market is likely to witness a wave of new products that cater to diverse applications.

Rising Popularity of Home Improvement Projects

The Sanding Pads Market is benefiting from the increasing popularity of home improvement projects. As more individuals engage in DIY activities, the demand for sanding pads is expected to rise. In 2025, the home improvement market is projected to grow at a rate of 5%, reflecting a shift in consumer behavior towards enhancing living spaces. Sanding pads are essential tools for homeowners looking to undertake various projects, from refinishing furniture to preparing surfaces for painting. This trend indicates a growing awareness of the importance of quality finishes in home aesthetics, which in turn drives the demand for effective sanding solutions. As the DIY culture continues to thrive, the sanding pads market is likely to see sustained growth, catering to the needs of both amateur and professional users.