Regulatory Pressure

Governments worldwide are implementing stringent regulations to limit salt consumption, thereby influencing the Global Salt Content Reduction Ingredients Market Industry. Initiatives such as salt reduction targets and labeling requirements are compelling food manufacturers to reformulate products. For instance, the World Health Organization advocates for a reduction in salt intake to less than 5 grams per day. This regulatory landscape is likely to drive innovation in salt reduction technologies, as companies strive to comply with these mandates while maintaining product quality and taste.

Rising Health Awareness

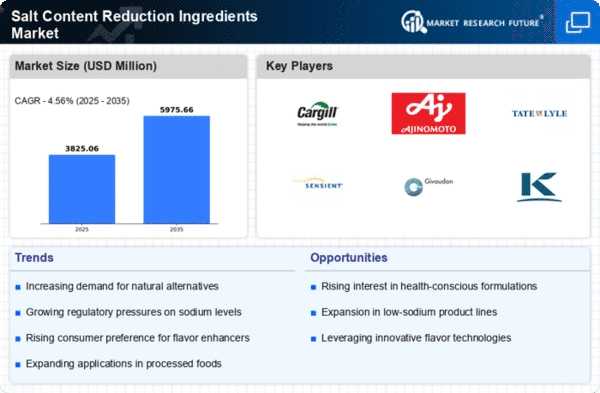

The increasing global awareness regarding health and wellness is driving the Global Salt Content Reduction Ingredients Market Industry. Consumers are becoming more conscious of their dietary choices, particularly concerning sodium intake, which is linked to hypertension and cardiovascular diseases. This shift in consumer behavior is prompting food manufacturers to seek alternatives that can reduce salt content without compromising flavor. As a result, the market is projected to grow from 3.66 USD Billion in 2024 to 5.97 USD Billion by 2035, reflecting a compound annual growth rate of 4.55% from 2025 to 2035.

Market Growth Projections

The Global Salt Content Reduction Ingredients Market Industry is projected to experience robust growth, with estimates indicating an increase from 3.66 USD Billion in 2024 to 5.97 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 4.55% from 2025 to 2035. Such projections highlight the increasing importance of salt reduction in food formulation as health concerns and regulatory pressures continue to shape consumer preferences. The market's expansion is likely to be fueled by ongoing innovations and the development of effective salt reduction solutions.

Technological Advancements

Innovations in food technology are significantly impacting the Global Salt Content Reduction Ingredients Market Industry. Advances in flavor enhancement techniques and the development of salt substitutes are enabling manufacturers to create products with lower sodium content. For example, the use of potassium chloride and other natural flavor enhancers allows for the reduction of salt without sacrificing taste. These technological improvements not only cater to health-conscious consumers but also align with industry trends towards cleaner labels and natural ingredients, further propelling market growth.

Growing Demand for Processed Foods

The increasing consumption of processed foods is a key driver of the Global Salt Content Reduction Ingredients Market Industry. As urbanization and busy lifestyles lead to a preference for convenience foods, the demand for products with reduced salt content is rising. Food manufacturers are responding by reformulating their offerings to meet consumer expectations for healthier options. This trend is particularly evident in the snack and ready-to-eat meal segments, where salt reduction is becoming a critical factor in product development, thereby expanding the market.

Consumer Preference for Natural Ingredients

There is a notable shift in consumer preference towards natural and clean-label ingredients, which is influencing the Global Salt Content Reduction Ingredients Market Industry. As consumers become more discerning about food additives and preservatives, they are increasingly favoring products that utilize natural salt reduction alternatives. This trend is prompting manufacturers to explore options such as seaweed extracts and other plant-based ingredients that can effectively reduce sodium levels while appealing to health-conscious consumers. Consequently, this preference is likely to drive innovation and growth within the market.