Growth in Construction Activities

The construction industry significantly influences the Rubber Compound Market, as rubber compounds are essential in various applications, including flooring, roofing, and insulation materials. With urbanization and infrastructure development on the rise, the demand for durable and versatile materials is increasing. In 2025, the construction sector is anticipated to contribute notably to the rubber compound consumption, with projections indicating a growth rate of approximately 5% annually. This growth is likely to be fueled by the need for sustainable building materials, which rubber compounds can provide, thus enhancing the overall market dynamics of the Rubber Compound Market.

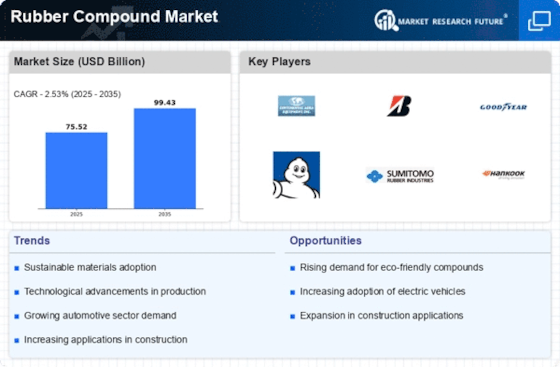

Increasing Focus on Sustainability

Sustainability initiatives are becoming increasingly prominent within the Rubber Compound Market. Manufacturers are exploring eco-friendly alternatives and sustainable practices to meet consumer demand for greener products. The shift towards bio-based rubber compounds and recycling initiatives is gaining traction, as companies aim to reduce their environmental footprint. In 2025, it is expected that a significant portion of the rubber compound production will incorporate sustainable materials, reflecting a broader trend towards environmental responsibility. This focus on sustainability may not only enhance brand reputation but also drive innovation within the Rubber Compound Market.

Rising Demand from Automotive Sector

The automotive sector is a primary driver for the Rubber Compound Market, as it increasingly relies on rubber compounds for tires, seals, and various components. The demand for high-performance tires, which utilize advanced rubber compounds, is projected to grow, driven by the need for improved fuel efficiency and safety. In 2025, the automotive industry is expected to account for a substantial share of the rubber compound consumption, with estimates suggesting that nearly 60% of the total rubber production is utilized in this sector. This trend indicates a robust growth trajectory for the Rubber Compound Market, as manufacturers adapt to evolving consumer preferences and regulatory standards.

Expansion of the Tire Recycling Market

The tire recycling market is emerging as a crucial driver for the Rubber Compound Market. As the demand for recycled rubber increases, manufacturers are exploring ways to incorporate recycled materials into new rubber compounds. This trend is likely to gain momentum in 2025, as regulatory pressures and consumer preferences shift towards sustainable practices. The integration of recycled rubber into new products can potentially lower production costs and reduce waste, thereby enhancing the overall efficiency of the Rubber Compound Market. This expansion may also lead to new business opportunities and partnerships within the recycling sector.

Technological Innovations in Rubber Processing

Technological advancements in rubber processing techniques are reshaping the Rubber Compound Market. Innovations such as improved mixing technologies and advanced curing processes enhance the performance characteristics of rubber compounds, making them more suitable for diverse applications. These innovations not only improve product quality but also increase production efficiency, potentially reducing costs. As manufacturers adopt these technologies, the market is likely to witness a surge in the development of specialized rubber compounds tailored for specific applications, thereby expanding the overall market landscape of the Rubber Compound Market.