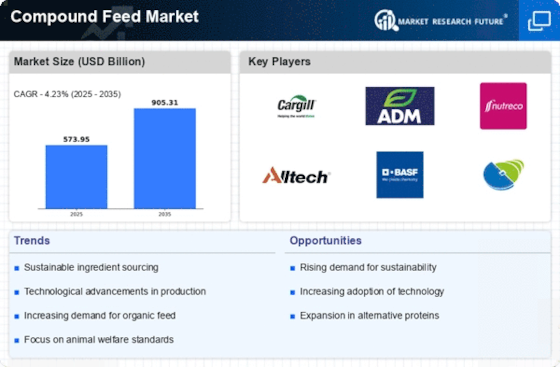

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the compound feed market grow even more. Market participants are also undertaking numerous strategic activities to expand their footprint, with important market developments such as contractual agreements, new product launches, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the compound feed industry must offer cost-effective items.

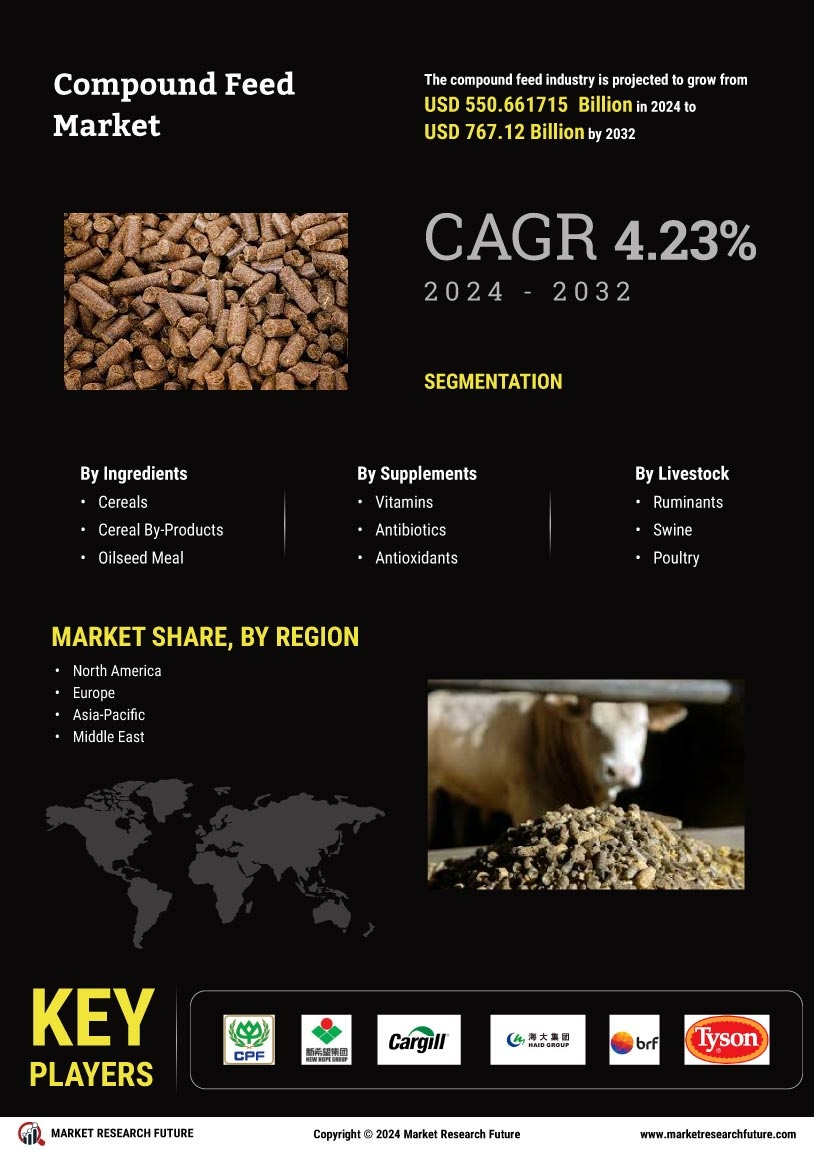

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the compound feed industry to benefit clients and increase the market sector. Major players in the compound feed market, including Charoen Pokphand Foods PCL (Thailand), New Hope Group (China), Cargill, Inc. (U.S.), Land O' Lakes (U.S.), Guangdong HAID Group Co., Ltd. (China), and others, are attempting to increase market demand by investing in research and development operations.

Cargill Inc is an agribusiness company providing products and services in food, financial, agricultural, industrial and risk management. It carries out the marketing, processing, and distribution of grains, oilseeds, sugar, meat, other food products, and cotton. It also manufactures natural ingredients for the personal care industry, pet food, animal feed and bio-industrial products. The company provides technical support, data asset solutions, transportation and logistics, risk management, and marketing services. In addition, the company produces and distributes starch and starch sweeteners, fuel ethanol and biodiesel.

Cargill markets its feed and pet food products under several brands, including Nutrena, Provimi, Cargill, EWOS, Diamond V and Purina.

In April Cargill and Intelia entered into a strategic partnership to expand broiler performance via a new precision management tool. The data from this digital platform would help maximize bird health and well-being, operational performance, and efficiency.

Alltech Inc is an animal health and nutrition company. It provides natural nutritional products, solutions, technical information, and help to the animal nutrition and feed industry. The firm's product and service portfolio comprises yeast cultures and extracts, enzymes, organic minerals, biologically active proteins, flavors and direct-fed microbials for the treatment of mastitis, health and immunity problems. The products find application in productivity, animal reproduction and fertility in pigs, poultry, equine, aquaculture products, dairy cow and others. It has bioscience centers in the US.

In May 2021, Alltech recently introduced a new line of Lifeforce TM, premium equine complements, to the market. Supported by more than 40 years of scientific research and formulated with field-proven technologies, these supplements have been created to meet the requirements of modern horses throughout their lives, from interpretation to recreation.