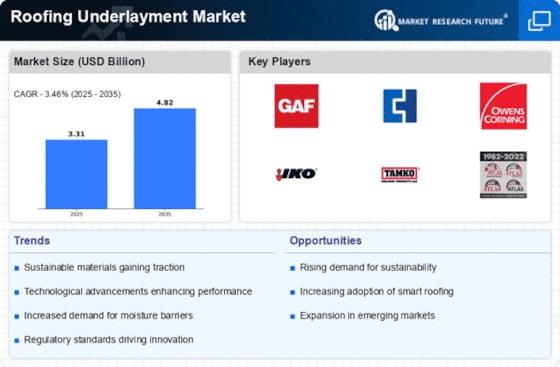

Increased Construction Activities

The Roofing Underlayment Market is experiencing a surge in demand due to heightened construction activities across various sectors. As urbanization continues to expand, the need for residential and commercial buildings rises, leading to increased roofing projects. According to recent data, construction spending has shown a steady increase, with a projected growth rate of approximately 5% annually. This trend is likely to drive the demand for roofing underlayment, as builders seek reliable materials to enhance the durability and performance of roofs. Furthermore, the emphasis on quality and longevity in construction materials suggests that roofing underlayment will play a crucial role in meeting these standards. As a result, manufacturers in the Roofing Underlayment Market are expected to innovate and expand their product offerings to cater to the evolving needs of the construction sector.

Rising Awareness of Energy Efficiency

The Roofing Underlayment Market is witnessing a growing emphasis on energy efficiency in building designs. As energy costs continue to rise, homeowners and builders are increasingly seeking materials that contribute to energy savings. Roofing underlayment plays a pivotal role in enhancing the thermal performance of roofs, thereby reducing energy consumption for heating and cooling. Recent studies indicate that roofs with high-quality underlayment can improve energy efficiency by up to 20%. This awareness is prompting architects and builders to incorporate advanced underlayment solutions into their projects, further driving market growth. Additionally, government incentives for energy-efficient building practices may bolster the demand for roofing underlayment, as stakeholders aim to comply with sustainability goals. Consequently, the Roofing Underlayment Market is likely to benefit from this trend as it aligns with broader environmental objectives.

Technological Innovations in Materials

The Roofing Underlayment Market is significantly influenced by ongoing technological innovations in material science. Manufacturers are increasingly developing advanced underlayment products that offer superior performance characteristics, such as enhanced moisture resistance, durability, and ease of installation. For instance, the introduction of synthetic underlayment has revolutionized the market, providing lightweight and robust alternatives to traditional felt. This shift is supported by data indicating that synthetic underlayment can outperform traditional materials in terms of lifespan and weather resistance. As builders and contractors become more aware of these advancements, the demand for innovative roofing underlayment solutions is expected to rise. Furthermore, the integration of smart technologies into roofing systems may also create new opportunities within the Roofing Underlayment Market, as stakeholders seek to enhance overall building performance.

Regulatory Standards and Building Codes

The Roofing Underlayment Market is increasingly shaped by stringent regulatory standards and building codes aimed at improving safety and performance in construction. Governments and regulatory bodies are implementing more rigorous requirements for roofing materials, including underlayment, to ensure compliance with safety and environmental standards. This trend is evident in various regions, where updated building codes mandate the use of specific underlayment types that meet performance criteria. As a result, manufacturers are compelled to adapt their product lines to align with these regulations, potentially leading to increased market competition. Moreover, compliance with these standards can enhance the credibility of roofing projects, making it a critical factor for builders and contractors. Consequently, the Roofing Underlayment Market is likely to see sustained growth as stakeholders prioritize adherence to evolving regulatory frameworks.

Growing Demand for Sustainable Materials

The Roofing Underlayment Market is experiencing a notable shift towards sustainable materials as environmental concerns gain prominence. Consumers and builders are increasingly prioritizing eco-friendly options in construction, leading to a rise in demand for underlayment products made from recycled or renewable resources. Recent market analysis suggests that the segment of sustainable roofing materials is projected to grow at a rate of 7% annually, reflecting a broader trend towards sustainability in the construction sector. This shift is not only driven by consumer preferences but also by regulatory pressures aimed at reducing the carbon footprint of building materials. As a result, manufacturers in the Roofing Underlayment Market are likely to invest in research and development to create innovative, sustainable underlayment solutions that meet the expectations of environmentally conscious consumers.