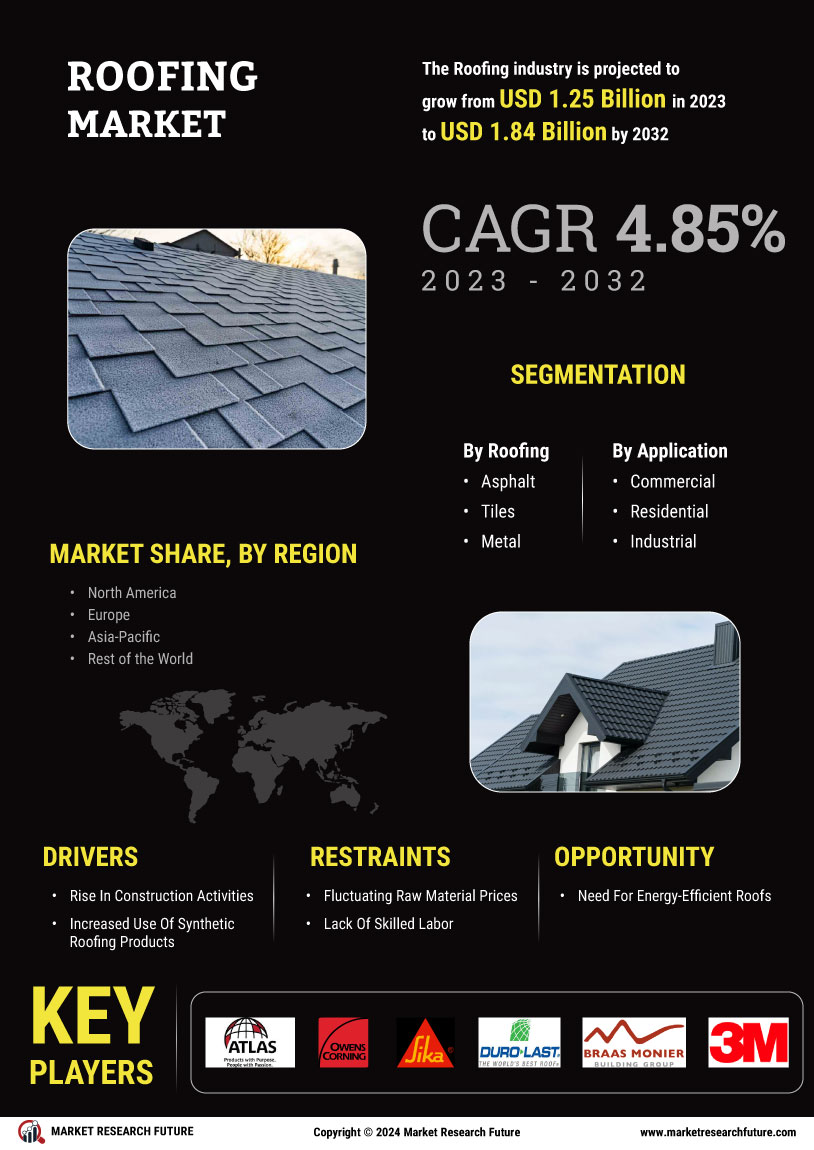

Rising Energy Costs

The escalating costs of energy are likely to influence the Roofing Market significantly. As energy prices continue to rise, consumers and businesses are increasingly seeking energy-efficient roofing solutions that can reduce heating and cooling costs. Reflecting this trend, the market for energy-efficient roofing materials, such as cool roofs and solar-integrated systems, is expanding. Reports suggest that energy-efficient roofing can lower energy consumption by up to 20%, making it an attractive option for cost-conscious consumers. This shift towards energy efficiency not only addresses economic concerns but also aligns with broader sustainability goals, thereby driving innovation within the Roofing Market.

Increased Urbanization

The ongoing trend of urbanization appears to be a significant driver in the Roofing Market. As populations migrate towards urban centers, the demand for residential and commercial buildings escalates, consequently increasing the need for roofing solutions. In many regions, urban areas are experiencing a construction boom, with new buildings requiring advanced roofing systems. This trend is further supported by data indicating that urban areas are projected to house approximately 68% of the world's population by 2050. Such demographic shifts necessitate innovative roofing materials and designs that can withstand urban environmental challenges, thereby propelling growth in the Roofing Market.

Climate Change Adaptation

The growing awareness of climate change is prompting a shift in the Roofing Market towards more resilient roofing solutions. As extreme weather events become more frequent, there is an increasing demand for roofing systems that can withstand harsh conditions, such as heavy rainfall, high winds, and extreme temperatures. This trend is reflected in the rising popularity of materials designed for durability and sustainability, such as metal and green roofs. Additionally, regulatory frameworks are evolving to encourage the adoption of climate-resilient roofing practices. This adaptation not only addresses immediate environmental concerns but also positions the Roofing Market for long-term growth in a changing climate.

Technological Advancements

Technological advancements are transforming the Roofing Market, introducing innovative materials and installation techniques. The integration of smart technologies, such as sensors and IoT devices, into roofing systems is becoming increasingly prevalent. These technologies enable real-time monitoring of roof conditions, enhancing maintenance and longevity. Furthermore, advancements in materials science have led to the development of lightweight, durable, and environmentally friendly roofing options. For instance, the use of synthetic materials and advanced coatings can improve energy efficiency and weather resistance. As these technologies continue to evolve, they are expected to create new opportunities and challenges within the Roofing Market.

Regulatory Compliance and Standards

Regulatory compliance and evolving standards are critical drivers in the Roofing Market. Governments and local authorities are increasingly implementing building codes and regulations that mandate specific roofing materials and practices to enhance safety and sustainability. These regulations often focus on energy efficiency, fire resistance, and environmental impact, compelling manufacturers and contractors to adapt their offerings. For instance, many regions are adopting stricter energy codes that require the use of reflective roofing materials to reduce heat absorption. As compliance becomes more stringent, the Roofing Market must innovate to meet these standards, thereby driving growth and ensuring consumer safety.