Market Growth Projection

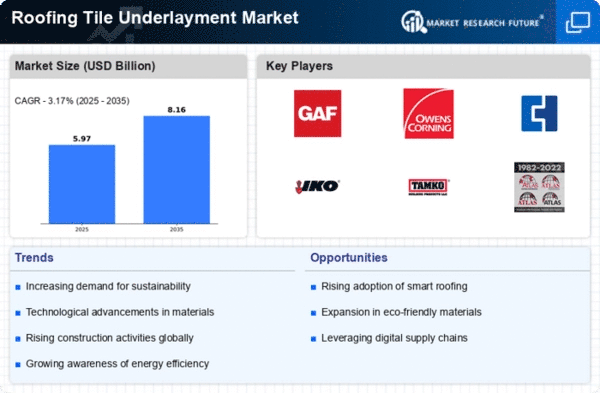

The Global Roofing Tile Underlayment Market Industry is projected to experience a compound annual growth rate (CAGR) of 3.17% from 2025 to 2035. This growth trajectory indicates a steady increase in demand for roofing tile underlayment products, driven by various factors such as construction activities, technological advancements, and regulatory support. The market's expansion reflects the ongoing evolution of the roofing industry, where quality and performance are paramount. As stakeholders adapt to changing consumer preferences and regulatory landscapes, the industry is likely to witness a continuous influx of innovative products and solutions, further enhancing its growth prospects.

Technological Advancements

Technological advancements in roofing materials significantly influence the Global Roofing Tile Underlayment Market Industry. Innovations such as synthetic underlayment, which offers superior moisture resistance and durability, are gaining traction. These advancements improve the performance of roofing systems, making them more appealing to builders and homeowners alike. The introduction of lightweight materials enhances ease of installation, further driving demand. As manufacturers invest in research and development, the market is likely to see a surge in innovative products that meet evolving consumer preferences. This focus on technology not only enhances product offerings but also positions the industry for sustained growth in the coming years.

Rising Construction Activities

The Global Roofing Tile Underlayment Market Industry experiences growth driven by increasing construction activities worldwide. As urbanization accelerates, the demand for residential and commercial buildings rises. For instance, in 2024, the market is projected to reach 5.79 USD Billion, reflecting the growing need for durable roofing solutions. This trend is particularly evident in emerging economies, where infrastructure development is prioritized. The construction sector's expansion necessitates reliable underlayment products to enhance roof performance and longevity, thereby propelling market growth. As new projects emerge, the demand for high-quality roofing tile underlayment is expected to increase, contributing to the industry's overall expansion.

Regulatory Support and Standards

Regulatory support and the establishment of standards play a crucial role in shaping the Global Roofing Tile Underlayment Market Industry. Governments worldwide are implementing building codes and regulations that mandate the use of specific underlayment materials to ensure safety and durability. Compliance with these regulations often necessitates the use of high-quality underlayment products, driving demand in the market. As these standards evolve, manufacturers are compelled to innovate and enhance their product offerings to meet regulatory requirements. This dynamic creates opportunities for growth, as stakeholders seek compliant solutions that align with safety and performance standards.

Market Expansion in Emerging Economies

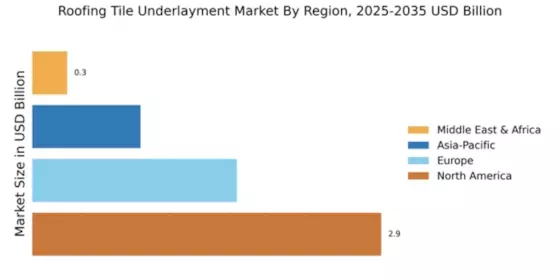

The Global Roofing Tile Underlayment Market Industry is witnessing significant expansion in emerging economies. Rapid urbanization and economic growth in regions such as Asia-Pacific and Latin America are driving increased construction activities. By 2035, the market is projected to reach 8.16 USD Billion, indicating robust growth potential. As these economies develop, the demand for residential and commercial roofing solutions rises, leading to a heightened need for quality underlayment products. This trend is further supported by government initiatives aimed at improving infrastructure, which creates a favorable environment for market players to capitalize on emerging opportunities.

Increased Awareness of Energy Efficiency

Growing awareness of energy efficiency and sustainability is a key driver for the Global Roofing Tile Underlayment Market Industry. Homeowners and builders are increasingly seeking roofing solutions that contribute to energy savings and environmental sustainability. Underlayment products that offer enhanced insulation properties can significantly reduce energy consumption, appealing to eco-conscious consumers. As regulations around energy efficiency tighten, the demand for roofing systems that comply with these standards is expected to rise. This shift towards sustainable building practices is likely to bolster the market, as more stakeholders recognize the long-term benefits of investing in energy-efficient roofing solutions.