Aesthetic Appeal

The aesthetic versatility of plastic roofing tiles is becoming increasingly relevant in the Plastic Roofing Tile Market. Homeowners and architects are seeking roofing solutions that not only provide functionality but also enhance the visual appeal of buildings. Plastic roofing tiles are available in a variety of colors, textures, and styles, allowing for creative design possibilities. This trend is supported by market data indicating a rising preference for customizable roofing options, which could lead to a projected increase in sales. As the demand for unique architectural designs grows, manufacturers are likely to expand their product lines to cater to diverse consumer tastes. This aesthetic flexibility may serve as a key differentiator in a competitive market, potentially driving higher adoption rates of plastic roofing tiles in residential and commercial projects.

Cost-Effectiveness

Cost considerations are a significant driver in the Plastic Roofing Tile Market, as consumers and builders seek affordable yet durable roofing solutions. Plastic roofing tiles often present a more economical option compared to traditional materials, such as wood or metal. Market analysis indicates that the initial investment in plastic roofing can be offset by lower maintenance costs and longer lifespan, making them an attractive choice for budget-conscious consumers. Additionally, the lightweight nature of plastic tiles can reduce installation costs, as they require less structural support. This cost-effectiveness is likely to resonate with both residential and commercial buyers, potentially leading to increased market penetration. As economic conditions fluctuate, the emphasis on cost-efficient building materials may further propel the demand for plastic roofing tiles.

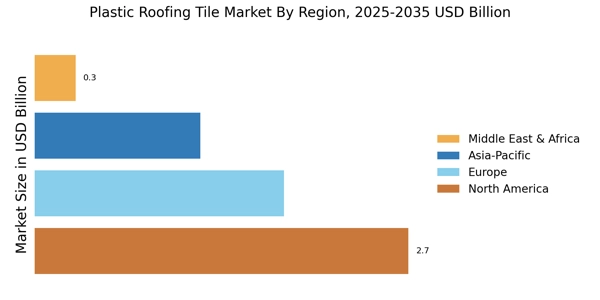

Regulatory Support

Regulatory frameworks promoting energy efficiency and sustainable building practices are influencing the Plastic Roofing Tile Market. Governments are increasingly implementing policies that encourage the use of eco-friendly materials in construction. This regulatory support is likely to create a favorable environment for plastic roofing tiles, which often meet or exceed energy efficiency standards. Market data suggests that regions with stringent building codes are witnessing a rise in the adoption of plastic roofing solutions, as they align with compliance requirements. Furthermore, incentives for using sustainable materials may further stimulate demand. As regulations evolve, manufacturers in the plastic roofing tile sector may need to adapt their offerings to meet these standards, potentially driving innovation and growth within the industry.

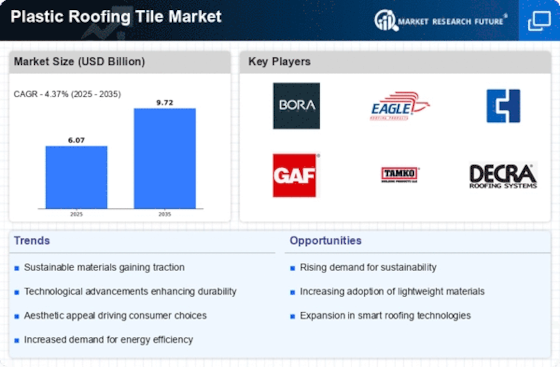

Technological Innovations

Technological advancements are reshaping the Plastic Roofing Tile Market, introducing innovative materials and manufacturing processes. Recent developments in polymer technology have led to the creation of more durable and lightweight roofing tiles, which could potentially enhance performance and longevity. Market data suggests that the adoption of advanced manufacturing techniques, such as 3D printing, is on the rise, allowing for greater customization and efficiency. These innovations not only improve product quality but also reduce production costs, making plastic roofing tiles more competitive against traditional materials. As technology continues to evolve, it is likely that the industry will witness further enhancements, driving growth and attracting new market entrants. The integration of smart technologies, such as sensors for monitoring roof conditions, may also emerge as a trend, adding value to plastic roofing solutions.

Sustainability Initiatives

The increasing emphasis on sustainability appears to be a pivotal driver for the Plastic Roofing Tile Market. As environmental concerns gain traction, consumers and builders are gravitating towards eco-friendly materials. Plastic roofing tiles, often made from recycled materials, align with these sustainability goals. This shift is reflected in market data, indicating a projected growth rate of approximately 6% annually in the sector. The demand for sustainable building materials is likely to continue influencing purchasing decisions, as regulations and consumer preferences evolve. Furthermore, the lifecycle benefits of plastic roofing tiles, including energy efficiency and reduced waste, enhance their appeal in the market. As a result, manufacturers are increasingly focusing on sustainable practices, which may further bolster the industry's growth.