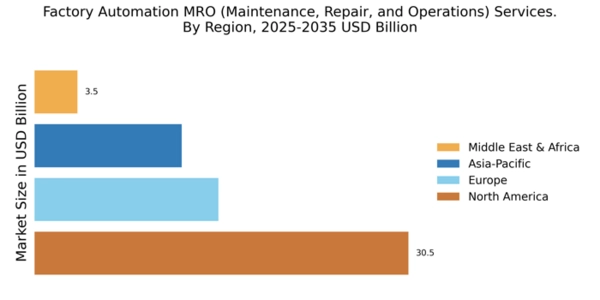

North America : Market Leader in Automation

North America is poised to maintain its leadership in the Factory Automation MRO services market, holding a significant share of 30.5% in 2024. The region's growth is driven by rapid technological advancements, increased investment in automation, and a strong focus on operational efficiency. Regulatory support for smart manufacturing and sustainability initiatives further catalyzes demand for MRO services, ensuring a robust market environment. The competitive landscape in North America is characterized by the presence of major players such as Rockwell Automation, Honeywell, and Siemens. These companies are leveraging innovative technologies and strategic partnerships to enhance service offerings. The U.S. remains the largest market, supported by a strong manufacturing base and a growing emphasis on digital transformation. This competitive edge positions North America as a key player in the global Factory Automation MRO landscape.

Europe : Emerging Automation Hub

Europe is emerging as a significant player in the Factory Automation MRO services market, with a market size of €15.0 billion. The region's growth is fueled by increasing investments in Industry 4.0 technologies and a strong regulatory framework promoting automation and efficiency. Countries are focusing on sustainability and digitalization, which are key drivers for MRO services, enhancing operational capabilities across various sectors. Leading countries such as Germany, France, and the UK are at the forefront of this growth, hosting major players like Schneider Electric and ABB. The competitive landscape is marked by innovation and collaboration among industry leaders, driving advancements in automation technologies. The European market is characterized by a strong emphasis on compliance with environmental regulations, which further boosts the demand for efficient MRO services.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region is witnessing rapid growth in the Factory Automation MRO services market, with a market size of $12.0 billion. This growth is driven by increasing industrialization, urbanization, and a shift towards smart manufacturing practices. Governments are implementing favorable policies and incentives to promote automation, which is significantly boosting the demand for MRO services across various industries. Countries like Japan, China, and South Korea are leading the charge, with key players such as Mitsubishi Electric and Yaskawa Electric making substantial investments in automation technologies. The competitive landscape is evolving, with a focus on innovation and efficiency. As the region continues to embrace digital transformation, the demand for advanced MRO services is expected to rise, positioning Asia-Pacific as a vital player in the global market.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is gradually emerging in the Factory Automation MRO services market, with a market size of $3.5 billion. The growth is primarily driven by increasing investments in infrastructure and industrial projects, alongside a growing recognition of the importance of automation in enhancing operational efficiency. Regulatory frameworks are evolving to support industrial growth, which is expected to further stimulate demand for MRO services in the region. Countries such as South Africa and the UAE are leading the market, with a focus on diversifying their economies and investing in technology. The competitive landscape is characterized by a mix of local and international players, striving to capture market share. As the region continues to develop its industrial capabilities, the demand for MRO services is anticipated to grow, presenting significant opportunities for stakeholders.