Research Methodology on the Residential Boiler market

Introduction

The research methodology by Market Research Future focuses on the approach used in conducting a market study into the Residential Boiler Market which is expected to experience phenomenal growth over the forecast period for 2023-2030. For this particular topic, primary data is collected from various industry experts, trade partners and residential boiler manufacturers, while the secondary data is used from multiple industry-level databases, trade journals and internal company databases.

Primary Research

Primary research is the initial stage of any research endeavour, thus, it is essential in this market research study. Primary data is collected through respondents from different organizations including industry experts and professionals, manufacturers and distributors, and other key suppliers in the industry. Face-to-face interviews, telephonic interviews and online questionnaire surveys are some of the methods used for primary data collection. The questions are categorised according to the needs and objectives of the research. This primary data is further validated with the industry-wide database for more accuracy.

Secondary Research

The secondary research involves referring to the various published sources related to the industry including trade journals, technical papers, and white papers. The research papers of organizations such as the Residential Boiler Manufacturers Association (RBMA) are also used for this research. Market data is obtained from various industry-level databases and the quarterly report on the Residential Boiler Market is also consulted.

Market Segmentation

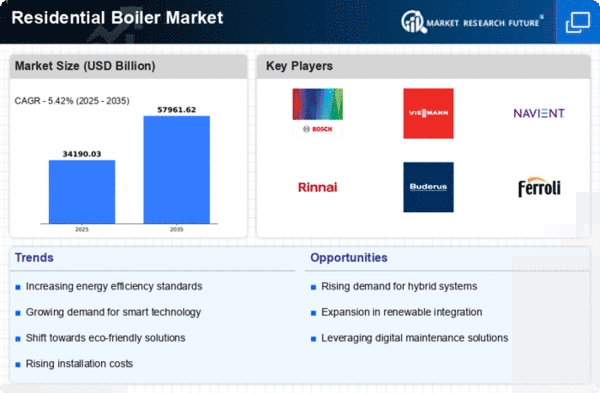

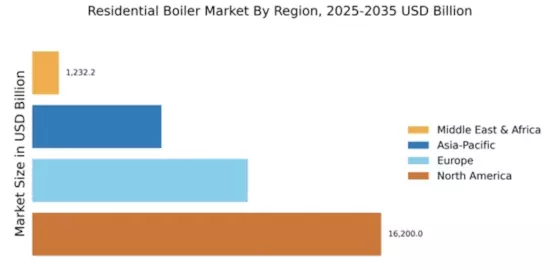

For this market research, the global residential boiler market is segmented based on product, application and region. By product, it is categorised into gas-fired, electric and oil-fired boilers. Based on application, the global residential boiler market is segmented into hot water, central heating and others. Lastly, it is segmented based on region into North America, Asia-Pacific, Europe, Latin America and Middle East & Africa.

Scalar Model

The research is based on the scalar model which focuses on the four parameters: industry environment, market size, market growth, and competitive landscape. By examining the external environment that affects the residential boiler market, company strategies and market structure, the competitive landscape is identified and their competitive strength is evaluated.

Data Collection

To acquire data related to the market size, market share, competitive landscape and overall market forecast, information is collected from intelligence reports, whitepapers, journals, magazines and other sources. This data is further validated with other sources such as press releases, industry journals and financial reports of the key market players. The data collected is then analysed using various analytical techniques and data triangulation.

Data Validation

The primary data is collected using various qualitative methods such as interviews, surveys, questionnaires and focus groups. For validating the primary data, multiple sources such as reports, industry associations, reference materials and case studies are used. The secondary data is collected from external sources such as published articles and reports from market intelligence firms.

Data Analysis

The data is analysed using various statistical techniques and analysis tools such as Porter’s Five Forces Analysis and SWOT Analysis. The data is further analysed to arrive at the market size, current trends and industry insights.

Market Estimation

The market estimation is done using various forecasting methods such as historical analysis, market dynamics, regression analysis, macro-economic analysis and survey-based analysis. By extrapolating the market data, the projected market size is determined for the forecast period 2023 to 20430

Conclusion

This research methodology covers the approach and methods used in conducting a comprehensive market study of the global Residential Boiler Market. Primary and secondary research is used to gather data which is further analysed using various statistics and analysis tools. Market estimation is done using various forecasting methods such as historical analysis and survey-based analysis. Based on the analysis of the collected data, the market size for the forecast period is determined.