Market Trends

Key Emerging Trends in the Recycled Carbon Fiber Market

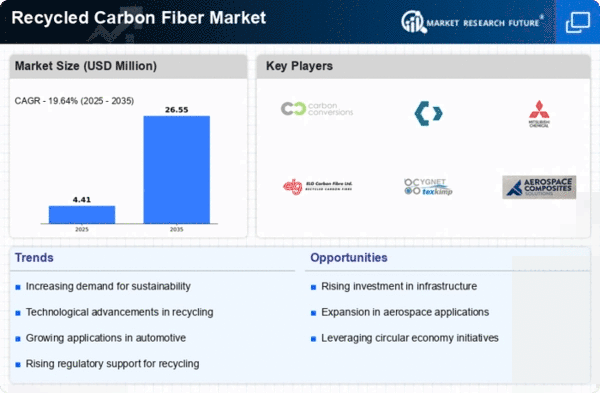

Recycled carbon fiber is emerging as a transformative powerhouse, revolutionizing industries such as automotive and aerospace & defense. Its ascendancy is fueled by a combination of cost-effectiveness, energy efficiency, lightweight attributes, and eco-friendly advantages. This material is making significant inroads, finding applications in various automotive components, including battery boxes, pressure vessels, and lift gate systems, highlighting its versatility and practicality. The surge in its adoption can be primarily attributed to the growing demand for lightweight and environmentally sustainable materials, spurred by stringent environmental regulations imposed by entities such as the European Union (EU) and the US Environmental Protection Agency (EPA), aiming to curb carbon emissions. A pivotal catalyst propelling the escalating demand for recycled carbon fibers is the global shift towards environmentally conscious practices. As regulatory bodies worldwide intensify emission standards, countries like India and China are witnessing a profound transformation in the automotive industry, steering towards lightweight materials that not only meet regulatory requirements but also align with the rising consumer preference for sustainable and fuel-efficient vehicles. The automotive sector, a primary beneficiary of recycled carbon fiber, has experienced a remarkable 48% expansion in global production between 2009 and 2019. This surge is particularly pronounced in emerging markets such as India, Mexico, Italy, China, Indonesia, Malaysia, and Thailand. Eastern European nations, including the Czech Republic, Turkey, Poland, Hungary, Romania, and Slovenia, are also significant contributors to this growth trajectory. Notably, automotive production soared from 31.2 billion units to 40.3 billion units in the first half of 2021, showcasing a robust 30% growth compared to the same period in 2020. The surging demand for lightweight and fuel-efficient vehicles, particularly in the light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs) segments, stands out as a pivotal factor driving the global recycled carbon fiber market. Regions like North America and Asia have witnessed a notable increase in the production of lightweight vehicles, with a 4.8% rise in North America and a substantial 10.2% surge in Asia in 2018. The commercial vehicle market in India experienced a remarkable 66% surge between 2014 and 2018, while China boasted a growth rate exceeding 15% during the same period. As commercial vehicle sales continue to surge in the Americas, Europe, and Asia-Pacific, collectively constituting over 80% of the global market, the demand for recycled carbon fiber is poised for a substantial upswing. The trifecta of versatility, cost-efficiency, and sustainability positions recycled carbon fiber as a critical enabler, reshaping the automotive industry's landscape while addressing both economic and environmental imperatives. the ascent of recycled carbon fiber signifies a paradigm shift in industries, fostering innovation and sustainability. The automotive and aerospace & defense sectors are increasingly embracing this revolutionary material, propelling the recycled carbon fiber market towards sustained growth and heightened prominence in the global industrial landscape.

Leave a Comment