Advancements in Biotechnology

Technological innovations in biotechnology are significantly influencing the Recombinant Vaccines Market. The advent of genetic engineering techniques, such as CRISPR and synthetic biology, has enhanced the ability to design and produce vaccines with improved efficacy and safety profiles. These advancements facilitate the rapid development of vaccines tailored to specific pathogens, thereby addressing public health challenges more effectively. The Recombinant Vaccines Market is expected to benefit from these technological breakthroughs, as they enable manufacturers to streamline production processes and reduce costs. Consequently, the market is likely to expand as more players enter the field, leveraging these cutting-edge technologies.

Emerging Markets and Expanding Access

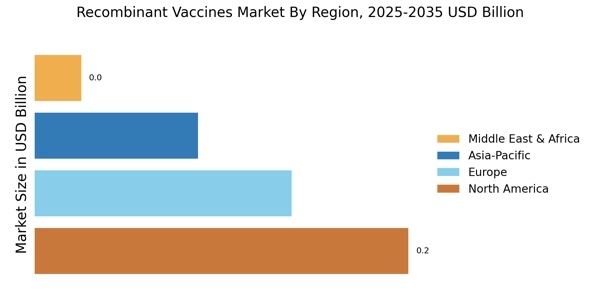

Emerging markets are becoming increasingly important for the Recombinant Vaccines Market. As economies develop, there is a growing demand for vaccines, driven by rising incomes and improved healthcare infrastructure. Countries in Asia, Africa, and Latin America are witnessing a surge in vaccination programs, supported by international organizations and local governments. This expansion of access to vaccines is likely to create new opportunities for manufacturers in the Recombinant Vaccines Market. Furthermore, as these markets continue to grow, the demand for innovative and effective vaccines will likely increase, prompting companies to invest in research and development to meet the needs of diverse populations.

Rising Incidence of Infectious Diseases

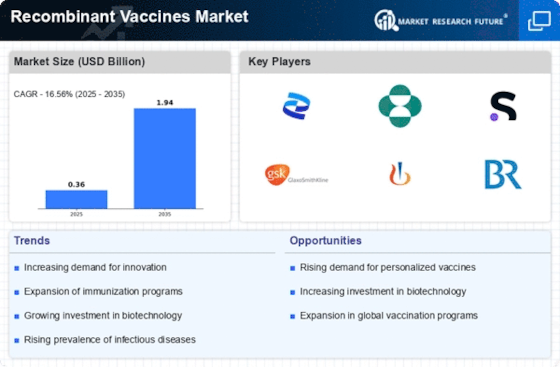

The increasing prevalence of infectious diseases is a primary driver for the Recombinant Vaccines Market. As pathogens evolve and new strains emerge, the demand for effective vaccines rises. For instance, the World Health Organization has reported a surge in vaccine-preventable diseases, which necessitates the development of innovative vaccines. This trend is likely to propel investments in recombinant vaccine technologies, as they offer rapid development and adaptability to emerging threats. The Recombinant Vaccines Market is projected to witness substantial growth, with estimates suggesting a compound annual growth rate of over 10% in the coming years, driven by the urgent need for effective immunization strategies.

Increased Government Funding and Support

Government initiatives and funding play a crucial role in shaping the Recombinant Vaccines Market. Many countries are recognizing the importance of vaccine development in safeguarding public health and are allocating substantial resources to support research and development. For example, various governments have established grants and incentives for companies engaged in recombinant vaccine research. This financial backing not only accelerates the development of new vaccines but also fosters collaboration between public and private sectors. As a result, the Recombinant Vaccines Market is poised for growth, with increased investment likely to lead to the introduction of novel vaccines that address unmet medical needs.

Growing Awareness of Preventive Healthcare

The rising awareness of preventive healthcare is driving the Recombinant Vaccines Market. As populations become more health-conscious, there is a growing emphasis on vaccination as a proactive measure to prevent diseases. Public health campaigns and educational initiatives are effectively promoting the benefits of vaccination, leading to higher immunization rates. This trend is particularly evident in emerging markets, where access to vaccines is improving. The Recombinant Vaccines Market stands to gain from this shift in consumer behavior, as individuals increasingly seek out vaccines that offer protection against a range of infectious diseases. This heightened demand is likely to stimulate market growth in the coming years.