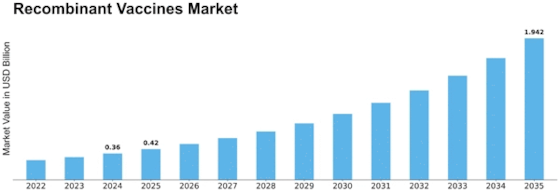

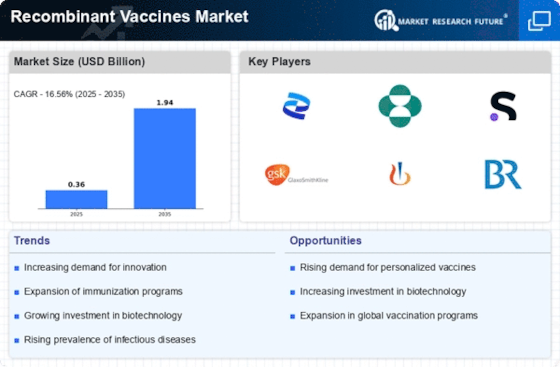

Recombinant Vaccines Size

Recombinant Vaccines Market Growth Projections and Opportunities

The global healthcare landscape has a game changer known as the Recombinant Vaccines Market that represents a transformative approach to vaccine development. The basic steps to create recombinant vaccines include gene insertion into host organisms and expression of proteins, which induce an immune reaction in the body. Consequently, this methodology has been instrumental in developing vaccines for various communicable diseases including Hepatitis B, Human Papilloma Virus (HPV) and Influenza.

A particular advantage of these vaccines is their safety profile. The traditional vaccines are often based on attenuated or inactivated forms of pathogens that may pose minor risk of infection to some individuals. Conversely, non-infectious elements are used by recombinant vaccines thereby reducing possibility of side effects. As such, the issue of safety has positioned recombinant vaccinations as the preferred choice for immunization in vulnerable areas such as among babies and those with weakened immunity.

Infectious diseases have been effectively prevented and controlled through the Recombinant Vaccines Market. For example, hepatitis B vaccine, which was among the first recombinant vaccines created has significantly contributed towards lowering the burden of this viral infection worldwide. Similarly, there exist recombinant HPV vaccines that have been helpful/ useful in preventing cervical cancer thereby pointing out how novel forms of immunization bring significant changes in public health.

New emerging infectious threats also drive growth of recombinant vaccine development by market players due to technological advancements. This happened after COVID-19 pandemic struck leading to immediate research innovations that saw creation of recombinant vaccines against SARS-CoV-2 virus. Such interventions have demonstrated high efficacy in prevention severe illness and transmission hence indicating versatility inherent within recombination technology when it comes to managing emerging challenges in public health.

The Recombinant Vaccines Market is present globally with great uptake whether it be developed or developing regions. Global organizations international agencies such like government departments and non-governmental organizations are promoting the use of recombinant vaccines by making sure every person in need gets them especially in order to eradicate disparities related to health. The need for cooperation while distributing these vaccines globally has been highlighted by initiatives aimed at low resource settings such as COVAX.

This might impede accessibility in low-income areas due to high production and distribution costs experienced within the market. As a result, partnerships, technology transfer agreements and exploration of novel production techniques have been put in place to address these challenges with respect to affordability while increasing scalability.

Growth and innovation lie ahead for the Recombinant Vaccines Market. Currently, research efforts are underway to expand the range of infectious diseases targeted by recombinant vaccines. Also important is that vaccine delivery technologies including mRNA platforms have seen tremendous breakthroughs that will eventually shape this field transforming it into one which can offer quick responses towards emerging threats.

Leave a Comment