Purified Terephthalic Acid PTA Market Summary

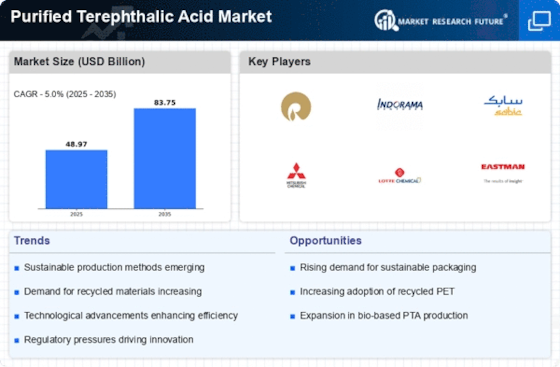

As per Market Research Future analysis, the Purified Terephthalic Acid Market Size was estimated at 48.97 USD Billion in 2024. The Purified Terephthalic Acid industry is projected to grow from 51.42 USD Billion in 2025 to 83.75 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.0% during the forecast period 2025 - 2035

Key Market Trends & Highlights

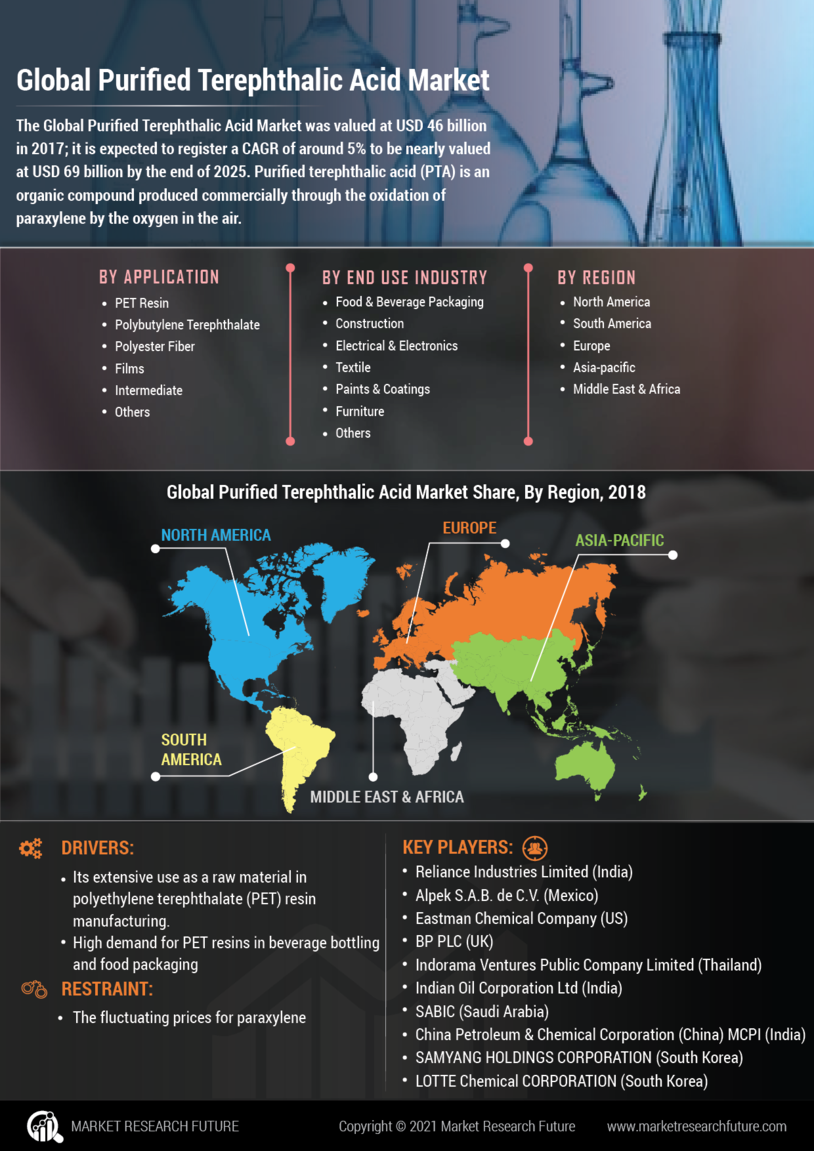

The Purified Terephthalic Acid Market is poised for robust growth driven by sustainability and technological advancements.

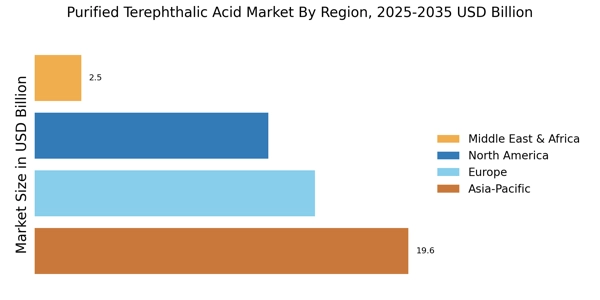

- North America remains the largest market for purified terephthalic acid, primarily due to its established manufacturing base.

- Asia-Pacific is emerging as the fastest-growing region, fueled by increasing industrialization and urbanization.

- The PET resin segment dominates the market, while the polyester fiber segment is experiencing rapid growth due to rising consumer demand.

- Key market drivers include the rising demand for PET and regulatory support for sustainable practices, which are shaping industry dynamics.

Market Size & Forecast

| 2024 Market Size | 48.97 (USD Billion) |

| 2035 Market Size | 83.75 (USD Billion) |

| CAGR (2025 - 2035) | 5.0% |

Major Players

Reliance Industries (IN), Indorama Ventures (TH), SABIC (SA), Mitsubishi Chemical (JP), Lotte Chemical (KR), Eastman Chemical (US), BASF (DE), Formosa Plastics (TW), PetroChina (CN), China National Petroleum Corporation (CN)