Technological Innovations

Technological innovations play a crucial role in advancing the Pumped Hydro Storage Market. Recent developments in turbine efficiency, automation, and control systems have enhanced the performance and reliability of pumped hydro storage facilities. These innovations not only reduce operational costs but also improve the overall efficiency of energy storage systems. As of 2025, the implementation of advanced technologies is expected to increase the capacity of existing pumped hydro storage plants by up to 20%. This evolution in technology is likely to attract further investments and drive the expansion of the market.

Environmental Sustainability Goals

Environmental sustainability goals are increasingly influencing the Pumped Hydro Storage Market. As concerns about climate change and environmental degradation rise, there is a growing emphasis on sustainable energy solutions. Pumped hydro storage is recognized for its low environmental impact compared to other energy storage technologies. In 2025, many countries are expected to adopt stricter environmental regulations, further driving the demand for eco-friendly energy storage options. This trend highlights the role of pumped hydro storage in achieving sustainability targets, making it a preferred choice for energy planners and policymakers.

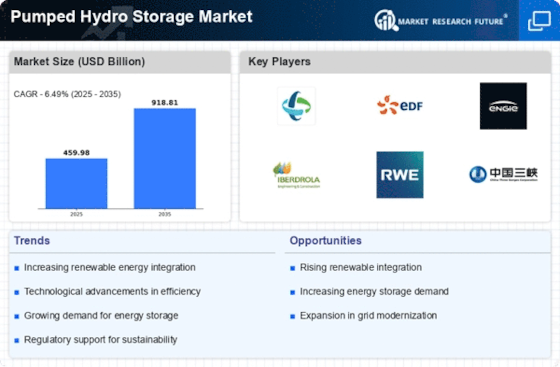

Growing Demand for Renewable Energy

The increasing demand for renewable energy sources is a primary driver for the Pumped Hydro Storage Market. As nations strive to meet ambitious climate goals, the integration of renewable energy into the grid has become essential. Pumped hydro storage systems provide a reliable solution for balancing supply and demand, particularly with the intermittent nature of solar and wind energy. In 2025, it is estimated that renewable energy sources will account for over 50% of total electricity generation in several regions. This shift necessitates robust energy storage solutions, positioning pumped hydro storage as a critical component in the energy transition.

Investment in Energy Infrastructure

Investment in energy infrastructure is a significant driver for the Pumped Hydro Storage Market. Governments and private entities are increasingly allocating funds to enhance energy storage capabilities, recognizing the need for resilient and efficient energy systems. In recent years, investments in pumped hydro storage projects have surged, with several countries announcing multi-billion dollar initiatives to expand their storage capacities. By 2025, the market is projected to witness a compound annual growth rate of approximately 8%, driven by these investments. This trend underscores the importance of pumped hydro storage in modernizing energy infrastructure.

Regulatory Frameworks and Incentives

Regulatory frameworks and incentives are vital drivers for the Pumped Hydro Storage Market. Governments worldwide are implementing policies that promote energy storage solutions as part of their energy transition strategies. These regulations often include financial incentives, tax breaks, and streamlined permitting processes for pumped hydro storage projects. By 2025, it is anticipated that supportive regulatory environments will facilitate the development of new pumped hydro storage facilities, potentially increasing installed capacity by 15%. This proactive approach by policymakers is essential for fostering growth in the energy storage sector.