Research Methodology on Psoriasis Treatment Market

The systematic research methodology used in the preparation of this report on the psoriasis treatment market is divided into two main stages.

Primary Research:

Data obtained from primary sources is subjected to data triangulation methods with the help of tools such as structured questionnaires, interviews, surveys, and the combination of primary and secondary research sources. The main objective in this stage is to identify the opportunities, trends and challenges faced by the players operating in the psoriasis treatment market. It also helps to identify the important segments and regions in the market.

Secondary Research:

Secondary sources include company websites, press releases, industry magazines, published reports, and other trade journals. The objective of conducting this research is to analyze and obtain valuable insights about the industry that would be used for the development and economic analysis of the report.

Market Dynamics:

A combination of both qualitative and quantitative research is carried out to understand the various market dynamics such as drivers, challenges, opportunities, and trends in the psoriasis treatment market. These include:

• Market Drivers:

The escalating prevalence of psoriasis along with encouraging reimbursement policies and the rising adoption of biological drugs are the key factors driving the growth of the market.

• Market Restraints:

The high cost of treatment and certain side effects of psoriasis drugs restrict their adoption by the consumer.

• Market Opportunities:

The increasing emphasis on R&D activity by major players leading to an increase in the introduction of new drugs sustained growth in the geriatric population, and the growing focus on novel strategies like advancements in biologics are expected to present lucrative opportunities for the players operating in the market.

• Market Trends:

The growing focus of the industry players on drug patenting and drug pricing is the major trend in this market. Also, the expanding areas of application, such as the development of stents, injectables and wound care products, are likely to contribute to the growth of the global psoriasis treatment market.

Data Collection & Validation

The data is collected from primary and secondary sources and validated by various industry experts and stakeholders. Primary research includes in-depth interviews with executives, industry experts, and KOLs. Secondary research includes Factiva, Annual reports, industry magazines, marketing materials, relevant patent and regulatory databases, corporate presentations, and SEC filings.

Expert Panel Validation

The data gathered through primary research and secondary research is further validated by an expert panel. The panel consists of industry professionals and key opinion leaders in the market. The data is validated with the help of the panel’s discussions which involves the SWOT analysis and Porter’s Five Force Model.

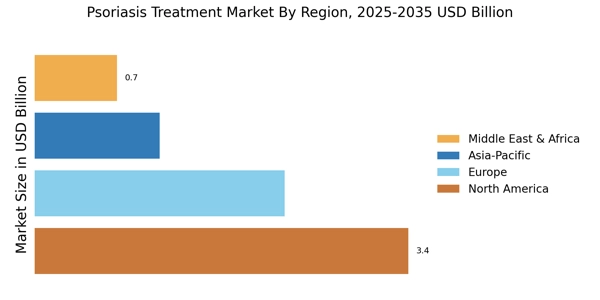

Market Estimation & Forecasting

The data obtained from the primary and secondary sources is further analyzed and triangulated to arrive at the global market size of the psoriasis treatment market for the base year. The data collected and analyzed is further used to estimate the market size for different segments such as by product, by application, by region, etc. All the market size estimations obtained through these methods are further validated through primary interviews with key opinion leaders and executives in the industry.

Data Interpretation & Analysis

A detailed qualitative and quantitative analysis of the market is concluded to derive the market dynamics and their respective impact on the growth of the market. The impact of the political, economic, and social factors on the industry is studied. The data and information collected are further analyzed using tools such as Porter’s five forces model and SWOT analysis. This information is further used to derive the attractiveness of each segment and draw insights into the growth trends in the market.

The base year for the analysis is 2022 and a forecast period is created from 2023 to 2030. The forecast is derived after in-depth analysis and examination of historical data and market trends. The assumptions made for the forecast are those which are unavoidable for the client's purposes and are based on the industry’s knowledge.

Conclusion

The research report on the Psoriasis Treatment Market provides an unbiased view of the market by analyzing the various market segments along with their size, share, growth rate, trends, and potential opportunities in the market. The research report also provides a thorough analysis of the competitive landscape of the market and discusses the strategies adopted by the companies to gain a competitive advantage in the market. The report also provides market estimates and forecasts for the global psoriasis treatment market and its regional markets.