Rising Awareness and Education

Increased awareness and education regarding psoriasis are driving the Psoriasis Drug Market. Campaigns aimed at educating both healthcare professionals and patients about the condition have led to improved diagnosis and treatment rates. As individuals become more informed about available therapies, they are more likely to seek treatment, thereby expanding the market. Furthermore, healthcare providers are increasingly recognizing the importance of early intervention, which can lead to better management of the disease. This heightened awareness is reflected in the growing number of support groups and online resources dedicated to psoriasis, fostering a community that encourages individuals to pursue effective treatment options. Consequently, the Psoriasis Drug Market is poised for growth as more patients engage with healthcare systems.

Advancements in Drug Development

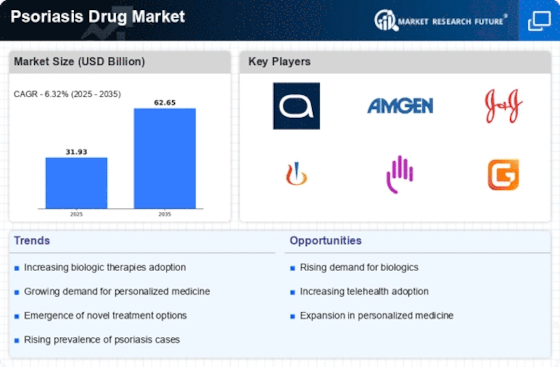

Technological advancements in drug development are significantly influencing the Psoriasis Drug Market. The emergence of novel therapeutic agents, particularly biologics and small molecules, has transformed treatment paradigms. For instance, the introduction of targeted therapies has shown promising results in clinical trials, leading to higher efficacy rates and improved patient outcomes. The market is projected to witness substantial growth, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years. These advancements not only enhance treatment options but also attract investment from pharmaceutical companies eager to capitalize on innovative solutions. As a result, the Psoriasis Drug Market is likely to experience a surge in new product launches, catering to diverse patient needs and preferences.

Increasing Prevalence of Psoriasis

The rising incidence of psoriasis is a pivotal driver for the Psoriasis Drug Market. Recent estimates indicate that psoriasis affects approximately 2-3% of the population in various regions, translating to millions of individuals seeking effective treatment options. This growing patient population necessitates the development and availability of innovative therapies, thereby propelling market growth. As awareness of the condition increases, more individuals are likely to seek medical advice and treatment, further expanding the market. The increasing prevalence is also linked to lifestyle factors, such as obesity and stress, which may exacerbate the condition. Consequently, pharmaceutical companies are motivated to invest in research and development to address this unmet medical need, thereby enhancing their market presence in the Psoriasis Drug Market.

Regulatory Support for New Treatments

Regulatory bodies are playing a crucial role in shaping the Psoriasis Drug Market by facilitating the approval of new treatments. Initiatives aimed at expediting the review process for innovative therapies have led to a more dynamic market environment. For instance, the introduction of fast-track designations for promising drugs has encouraged pharmaceutical companies to invest in research and development. This regulatory support not only accelerates the availability of new treatments but also instills confidence in investors and stakeholders. As a result, the market is likely to see an influx of novel therapies that address various aspects of psoriasis, catering to the diverse needs of patients. This trend underscores the importance of regulatory frameworks in fostering innovation within the Psoriasis Drug Market.

Growing Demand for Combination Therapies

The increasing demand for combination therapies is emerging as a significant driver in the Psoriasis Drug Market. Patients often experience varying degrees of severity and may not respond adequately to monotherapy. As a result, healthcare providers are increasingly adopting combination approaches that integrate multiple treatment modalities to enhance efficacy and minimize side effects. This trend is supported by clinical evidence suggesting that combination therapies can lead to improved patient outcomes. The market is witnessing a shift towards personalized treatment regimens, with estimates indicating that combination therapies could account for a substantial share of the market in the coming years. This evolving landscape highlights the need for pharmaceutical companies to innovate and develop synergistic treatment options within the Psoriasis Drug Market.