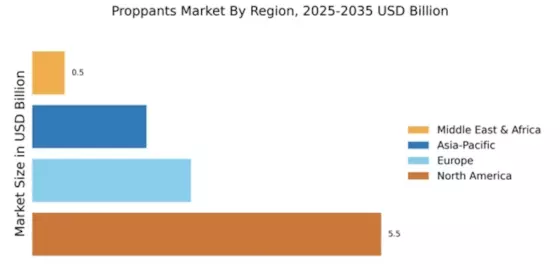

North America : Market Leader in Proppants

North America continues to lead the proppants market, holding a significant share of 5.5 in 2024. The growth is driven by the increasing demand for hydraulic fracturing in shale gas and oil extraction, supported by favorable regulations and technological advancements. The region's robust infrastructure and investment in energy projects further enhance market dynamics, making it a focal point for proppant suppliers.

The United States is the primary contributor to this market, with key players like Halliburton, Schlumberger, and U.S. Silica Holdings dominating the landscape. The competitive environment is characterized by innovation and strategic partnerships, ensuring a steady supply of high-quality proppants. As the market evolves, these companies are expected to leverage their expertise to meet the growing demand effectively.

Europe : Emerging Market Potential

Europe's proppants market is gaining traction, with a market size of 2.5 in 2024. The region is witnessing increased exploration and production activities, driven by the need for energy independence and the transition to cleaner energy sources. Regulatory support for unconventional gas extraction is also a catalyst for growth, as countries seek to enhance their energy security and reduce reliance on imports.

Leading countries in this region include Germany, the UK, and Poland, where significant investments are being made in shale gas exploration. The competitive landscape features both local and international players, with companies like Carbo Ceramics and Badger Mining Corporation expanding their presence. The market is expected to grow as regulatory frameworks become more favorable for proppant usage in hydraulic fracturing.

Asia-Pacific : Rapidly Growing Demand

The Asia-Pacific proppants market is on the rise, with a market size of 1.8 in 2024. The region's growth is fueled by increasing energy demands, particularly in countries like China and India, where industrialization and urbanization are driving the need for efficient energy extraction methods. Regulatory frameworks are gradually evolving to support unconventional gas production, further enhancing market prospects.

China and India are the leading countries in this market, with significant investments in shale gas exploration. The competitive landscape is becoming more dynamic, with both domestic and international players vying for market share. Companies like Emerge Energy Services and Vista Proppants are expanding their operations to cater to the growing demand, positioning themselves as key contributors to the region's proppants market.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa (MEA) proppants market is still in its nascent stages, with a market size of 0.51 in 2024. However, the region presents significant opportunities for growth, driven by increasing investments in oil and gas exploration. The demand for proppants is expected to rise as countries seek to enhance their extraction capabilities and optimize production processes. Regulatory support for unconventional resource development is also a key driver.

Leading countries in this region include Saudi Arabia and South Africa, where the focus is on maximizing hydrocarbon recovery. The competitive landscape is characterized by a mix of local and international players, with companies like Select Energy Services making strides in establishing a foothold. As the market matures, the presence of key players is likely to expand, fostering a more competitive environment.