Proppants Size

Proppants Market Growth Projections and Opportunities

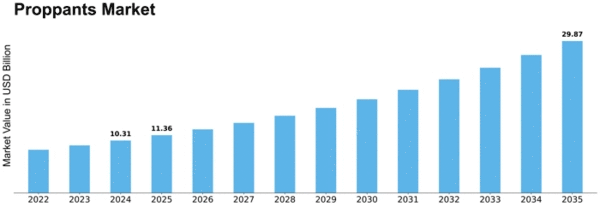

In 2022, Proppants' market size was estimated at USD 8.5 billion. The growth of the industry from USD 9.36 Billion in 2023 to USD 20.28 Billion by 2032 will show a compound annual growth rate (CAGR) of about 10.15%. Many factors can influence the Proppants Market and its development. One is that the oil and gas industry is thriving with a lot of hydraulic fracturing operations expansion taking place. Sand, resin-coated sand, and ceramics used together as proppants in hydraulic fracturing are vital for increasing the production of oil and gas from underground reservoirs all over the world. With energy needs soaring worldwide, exploration and production activities relating to unconventional oil and gas reserves have led to increased usage of proppants, resulting in their market expansion. Likewise, innovation regarding fracking has greatly impacted proppant marketability. This sector focuses its investments on research aimed at optimizing fracking processes, leading to better well productivity levels as well as enhanced hydrocarbon recovery rates. These innovative methods require proppants with better qualities and, thus, performance, such as high-volume hydraulic fracturing and horizontal drilling, which are more sophisticated techniques compared to traditional fracking methods. Having abundant shale reserves makes North America a major consumer of proppants because of their wide application in Oil & Gas production via fracking technology. Additionally, the construction industry influences proppant markets mainly through the demand for good-quality Silica sand, which is commonly used not only for hydraulic fracturing but also for concrete manufacturing and other building applications. On top of this, particular types like silica sands have ecological implications; hence, regulation on these provisions may limit their applicability. The use of certain types must be guided by government legislation covering areas pertaining to air pollution norms, protecting health safety measures for employees, and maintaining land reclamation methods during fracking. Obstacles involving unstable pricing, rivalry from other materials, and changes in the prices of gas and oil may influence Proppants Markets. The proppants sector is influenced by global petroleum price fluctuations affecting overall investment as well as drilling activities. In addition, competition with substitute proppants such as resin-coated sand and ceramic products creates a problem with the use of traditional sand as a prop.

Leave a Comment