Regulatory Support and Standardization

Regulatory support and standardization are emerging as critical drivers for the Professional Service Robot Market. Governments and industry bodies are increasingly recognizing the potential of service robots to enhance productivity and safety across various sectors. As a result, there is a push for the development of regulations and standards that facilitate the safe deployment of robots in public spaces. For instance, guidelines on robot interactions in healthcare settings are being established to ensure patient safety and privacy. This regulatory framework not only fosters consumer confidence but also encourages investment in robotic technologies. Furthermore, as standards become more defined, manufacturers are likely to benefit from reduced barriers to entry, thus stimulating competition and innovation within the Professional Service Robot Market.

Technological Advancements in Robotics

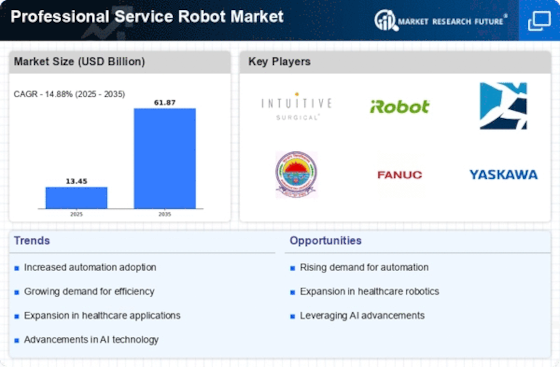

The Professional Service Robot Market is experiencing a surge in technological advancements, particularly in artificial intelligence and machine learning. These innovations enhance the capabilities of service robots, allowing them to perform complex tasks with greater efficiency and accuracy. For instance, robots equipped with advanced sensors and navigation systems can operate in dynamic environments, which is crucial for sectors like healthcare and logistics. The integration of AI enables robots to learn from their surroundings, improving their functionality over time. As a result, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This rapid evolution in technology not only drives demand but also encourages investment in research and development within the Professional Service Robot Market.

Rising Labor Costs and Workforce Shortages

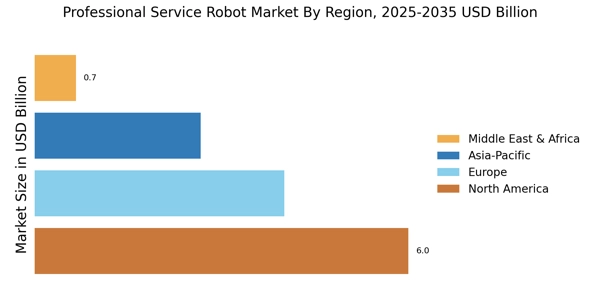

In many regions, rising labor costs and workforce shortages are compelling businesses to explore automation solutions, thereby propelling the Professional Service Robot Market. As companies face challenges in hiring and retaining skilled labor, the adoption of service robots becomes a viable alternative. For example, sectors such as hospitality and retail are increasingly deploying robots for tasks like cleaning, inventory management, and customer service. This shift not only reduces operational costs but also enhances service efficiency. According to recent data, the labor market is expected to remain tight, with unemployment rates projected to stay low. Consequently, the demand for professional service robots is likely to increase as organizations seek to maintain productivity and service quality amidst these challenges.

Growing Demand for Enhanced Customer Experience

The Professional Service Robot Market is witnessing a growing demand for enhanced customer experience across various sectors. Businesses are increasingly recognizing the value of integrating service robots to improve customer interactions and streamline operations. For instance, in retail, robots can assist customers by providing information and guiding them through stores, thereby creating a more engaging shopping experience. Similarly, in the hospitality sector, robots are being utilized for concierge services, which not only improves efficiency but also elevates customer satisfaction. Market Research Future indicates that companies investing in customer experience technologies, including service robots, are likely to see a return on investment through increased customer loyalty and sales. This trend underscores the importance of service robots in meeting evolving consumer expectations within the Professional Service Robot Market.

Increased Investment in Automation Technologies

The Professional Service Robot Market is benefiting from increased investment in automation technologies across multiple sectors. Businesses are recognizing the potential of service robots to enhance operational efficiency and reduce costs. This trend is particularly evident in industries such as logistics, where robots are deployed for tasks like sorting and delivery. Recent data indicates that investment in automation technologies is expected to reach unprecedented levels, with companies allocating significant budgets to integrate robotic solutions into their operations. This influx of capital not only accelerates the development of advanced robotic systems but also expands the range of applications for service robots. As organizations seek to remain competitive in an increasingly automated landscape, the demand for professional service robots is likely to continue its upward trajectory.