Labor Shortages

Labor shortages in the agricultural sector are a pressing issue that the Global Agriculture Robots Industry seeks to address. Many regions face declining numbers of agricultural workers, which can hinder productivity and crop yields. In response, farmers are increasingly turning to robotics to fill the gap. For example, robotic harvesters can efficiently gather crops, reducing reliance on manual labor. This trend is likely to accelerate as the industry anticipates reaching 18.4 USD Billion by 2035, driven by the need for innovative solutions to counteract labor shortages and maintain agricultural output.

Rising Food Demand

The Global Agricultural Robots Industry is significantly influenced by the rising global food demand driven by population growth and changing dietary preferences. As the world population is projected to reach approximately 9.7 billion by 2050, the pressure on agricultural systems to produce more food is intensifying. Robotics can enhance productivity and efficiency, enabling farmers to meet these demands. For example, automated planting and harvesting systems can increase crop yields while reducing labor costs. This growing necessity for increased food production is likely to propel the market forward, as stakeholders seek innovative solutions to ensure food security.

Sustainability Initiatives

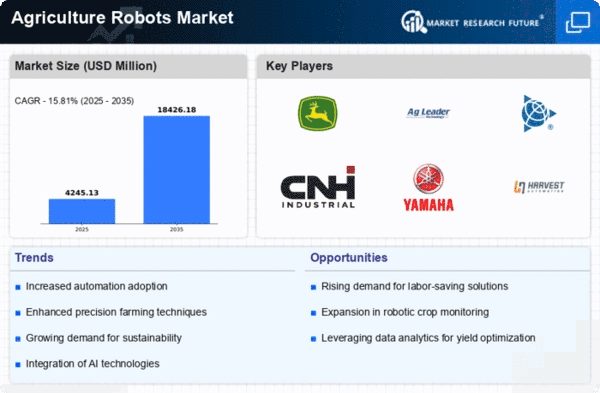

Sustainability initiatives are becoming a focal point within the Global agricultural robots Industry, as consumers and governments alike demand more environmentally friendly practices. Agricultural robots can contribute to sustainable farming by optimizing resource usage, reducing chemical inputs, and minimizing soil disturbance. For instance, precision agriculture technologies allow for targeted application of fertilizers and pesticides, which can lead to lower environmental impact. As sustainability becomes increasingly prioritized, the market is expected to grow at a CAGR of 15.81% from 2025 to 2035, reflecting the industry's commitment to eco-friendly agricultural practices.

Technological Advancements

The Global Agriculture Robots Market Industry is experiencing rapid technological advancements that enhance efficiency and productivity. Innovations in robotics, artificial intelligence, and machine learning are enabling the development of sophisticated agricultural robots capable of performing various tasks such as planting, harvesting, and monitoring crops. For instance, autonomous tractors equipped with GPS technology can operate with minimal human intervention, optimizing resource use. As these technologies evolve, they are expected to drive the market's growth, with the industry projected to reach 3.67 USD Billion in 2024, indicating a strong demand for advanced agricultural solutions.

Government Support and Funding

Government support and funding play a crucial role in the development of the Global Agriculture Robots Industry. Many governments are recognizing the potential of agricultural robotics to enhance food production and sustainability. Initiatives such as grants, subsidies, and research funding are being implemented to encourage innovation in this sector. For instance, various countries are investing in research programs aimed at developing advanced agricultural technologies. This support is likely to foster growth within the industry, as it encourages the adoption of robotics and automation in farming practices.