Sector-Specific Applications

The Professional Drone Service Market benefits from the diversification of applications across various sectors. Industries such as logistics, emergency services, and environmental monitoring are increasingly adopting drone technology for specialized tasks. In logistics, drones are being utilized for last-mile delivery, significantly reducing delivery times and costs. Emergency services leverage drones for search and rescue operations, providing critical support in disaster-stricken areas. Additionally, environmental monitoring through drones allows for efficient data collection on wildlife and natural resources. This sector-specific adoption not only enhances operational efficiency but also opens new revenue streams for drone service providers. The growing recognition of drones as valuable tools in diverse applications suggests a promising trajectory for the Professional Drone Service Market.

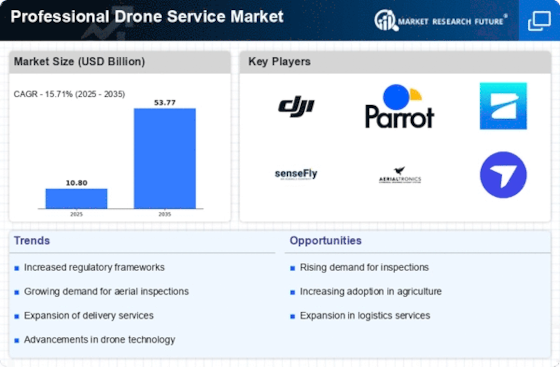

Advancements in Drone Technology

Technological innovations play a pivotal role in shaping the Professional Drone Service Market. The introduction of advanced sensors, improved battery life, and enhanced flight capabilities has broadened the scope of drone applications. For example, drones equipped with high-resolution cameras and LiDAR technology are increasingly utilized for mapping and surveying, providing precise data that was previously unattainable. Furthermore, the integration of artificial intelligence and machine learning into drone operations allows for real-time data analysis and decision-making. As these technologies continue to evolve, they are likely to drive further adoption of drone services across various industries, thereby propelling the Professional Drone Service Market forward. The ongoing advancements suggest a promising future for drone service providers as they adapt to meet the growing demands of diverse sectors.

Regulatory Support and Frameworks

The establishment of supportive regulatory frameworks is crucial for the growth of the Professional Drone Service Market. Governments worldwide are increasingly recognizing the potential of drone technology and are implementing regulations that facilitate safe and efficient drone operations. For instance, streamlined processes for obtaining flight permits and the development of designated airspace for drone activities are becoming more common. These regulatory advancements not only enhance safety but also encourage investment in drone services. As regulations evolve to accommodate the unique capabilities of drones, the Professional Drone Service Market is likely to witness accelerated growth. The proactive approach of regulatory bodies indicates a commitment to fostering innovation while ensuring public safety, which is essential for the sustainable development of the drone service sector.

Cost Efficiency and Operational Benefits

The Professional Drone Service Market is witnessing a shift towards cost efficiency and operational benefits as businesses seek to optimize their processes. Drones offer a cost-effective alternative to traditional methods of data collection and monitoring, reducing labor costs and time. For instance, aerial surveys that once required extensive manpower and equipment can now be conducted swiftly and accurately using drones. This efficiency translates into significant savings for companies, making drone services an attractive option. Moreover, the ability to gather real-time data enhances decision-making processes, allowing businesses to respond promptly to changing conditions. As organizations increasingly recognize the financial and operational advantages of drone services, the Professional Drone Service Market is poised for continued growth, driven by the demand for innovative and efficient solutions.

Increased Demand for Aerial Data Collection

The Professional Drone Service Market experiences a notable surge in demand for aerial data collection across various sectors. Industries such as agriculture, construction, and real estate increasingly rely on drones for efficient data acquisition. For instance, the agricultural sector utilizes drones for crop monitoring and precision farming, which enhances yield and reduces costs. In construction, drones facilitate site surveys and progress monitoring, leading to improved project management. According to recent estimates, the market for aerial data collection services is projected to grow significantly, indicating a robust trend towards integrating drone technology into traditional practices. This growing reliance on aerial data collection underscores the potential for the Professional Drone Service Market to expand as businesses seek innovative solutions to enhance operational efficiency.