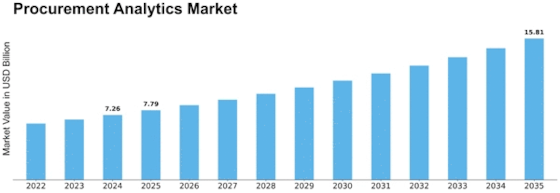

Procurement Analytics Size

Procurement Analytics Market Growth Projections and Opportunities

The procurement analytics market is experiencing dynamic shifts, driven by a confluence of factors reshaping the landscape. In recent years, businesses across various industries have recognized the pivotal role of procurement analytics in optimizing their sourcing strategies, supplier relationships, and overall operational efficiency. This heightened awareness has propelled the demand for advanced analytics solutions tailored to the unique needs of procurement professionals.

One key driving force behind the evolving market dynamics is the increasing complexity of global supply chains. As businesses expand their operations internationally, they face challenges in managing diverse supplier networks, fluctuating commodity prices, and geopolitical uncertainties. In response, procurement teams are turning to analytics to gain deeper insights into supplier performance, identify cost-saving opportunities, and mitigate risks.

Moreover, the proliferation of big data and advanced analytics technologies has empowered organizations to harness vast amounts of procurement-related data for strategic decision-making. From transactional data on purchase orders and invoices to unstructured data from emails and contracts, procurement analytics platforms offer powerful capabilities to extract actionable insights and drive business value.

Furthermore, the rise of artificial intelligence (AI) and machine learning (ML) technologies is revolutionizing how procurement analytics is conducted. These technologies enable predictive and prescriptive analytics, allowing organizations to forecast demand, optimize inventory levels, and automate routine procurement tasks. By leveraging AI-driven insights, procurement professionals can make faster, more informed decisions and adapt to changing market conditions with agility.

Another factor shaping the market dynamics is the increasing emphasis on sustainability and corporate social responsibility (CSR) in procurement practices. Businesses are under pressure to ensure ethical sourcing practices, minimize environmental impact, and support diversity and inclusion initiatives throughout their supply chains. Procurement analytics solutions play a crucial role in monitoring supplier compliance, identifying sustainable sourcing opportunities, and measuring the environmental and social impact of procurement decisions

Additionally, the COVID-19 pandemic has highlighted the importance of resilience and adaptability in supply chain management. The disruption caused by the pandemic has prompted organizations to reevaluate their procurement strategies, diversify their supplier base, and build robust risk management capabilities. In this context, procurement analytics has emerged as a strategic imperative for enhancing supply chain visibility, identifying vulnerabilities, and optimizing inventory levels to mitigate disruptions.

Furthermore, the growing trend towards digital transformation is driving the adoption of cloud-based procurement analytics solutions. Cloud platforms offer scalability, flexibility, and accessibility, enabling organizations to deploy analytics tools rapidly and integrate data from disparate sources. Moreover, cloud-based solutions facilitate collaboration among geographically dispersed teams and support real-time decision-making, enhancing agility and responsiveness in procurement operations.

Leave a Comment