Market Growth Projections

The Global Processed Eggs Industry is poised for growth, with projections indicating a compound annual growth rate (CAGR) of 3.75% from 2025 to 2035. This growth trajectory suggests a robust demand for processed egg products, driven by various factors such as health trends, convenience, and technological advancements. The market is expected to evolve, with innovations in product offerings and processing techniques. As consumer preferences shift towards more convenient and nutritious options, the industry is likely to adapt, ensuring sustained growth in the coming years.

Expansion of Food Service Sector

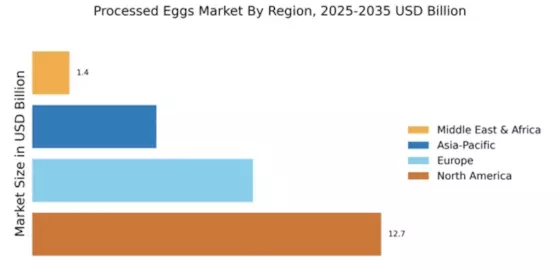

The expansion of the food service sector significantly influences the Global Processed Eggs Industry. As the number of restaurants, cafes, and catering services continues to grow, the demand for processed egg products rises correspondingly. Processed eggs are favored in food service due to their consistency, ease of use, and reduced preparation time. This trend is particularly pronounced in regions with a burgeoning food culture, where culinary innovation drives the use of processed ingredients. The market is anticipated to grow, with projections indicating a rise to 38.6 USD Billion by 2035, as the food service sector increasingly incorporates processed eggs into their offerings.

Health and Nutritional Awareness

Health consciousness among consumers is a significant driver for the Global Processed Eggs Industry. As individuals become more aware of the nutritional benefits of eggs, including high protein content and essential vitamins, the demand for processed egg products is likely to increase. This awareness is fostering a shift towards healthier eating habits, with processed eggs being perceived as a nutritious option for various meals. The industry is responding by developing products that cater to health-focused consumers, such as low-cholesterol and organic options. This trend may contribute to the market's growth, as consumers prioritize health in their dietary choices.

Rising Demand for Convenience Foods

The Global Processed Eggs Industry experiences a notable surge in demand for convenience foods, driven by changing consumer lifestyles. As more individuals seek quick meal solutions, processed eggs, which offer versatility and ease of preparation, become increasingly popular. This trend is particularly evident in urban areas where busy schedules limit cooking time. The market is projected to reach 25.8 USD Billion in 2024, reflecting the growing preference for ready-to-eat and easy-to-cook products. This shift towards convenience is likely to propel the processed eggs segment, as manufacturers innovate to meet consumer expectations for quality and convenience.

Global Trade and Export Opportunities

Global trade dynamics present substantial opportunities for the Global Processed Eggs Industry. Countries with robust poultry industries are increasingly exporting processed egg products to meet international demand. This trend is facilitated by trade agreements and the reduction of tariffs, allowing for greater market access. For instance, nations such as the United States and the European Union are significant players in the global processed egg trade, exporting a variety of products to regions with high consumption rates. This expansion into international markets may bolster the industry's growth, as companies seek to capitalize on emerging markets and diversify their product offerings.

Technological Advancements in Processing

Technological advancements in the processing of eggs play a crucial role in enhancing the Global Processed Eggs Industry. Innovations in pasteurization, drying, and packaging technologies improve product safety, shelf life, and quality. These advancements enable manufacturers to produce a wider range of processed egg products, catering to diverse consumer needs. For instance, the introduction of liquid egg products has revolutionized the market, providing convenience for both consumers and food service operators. As technology continues to evolve, it is expected that the industry will see increased efficiency and product variety, further driving market growth.