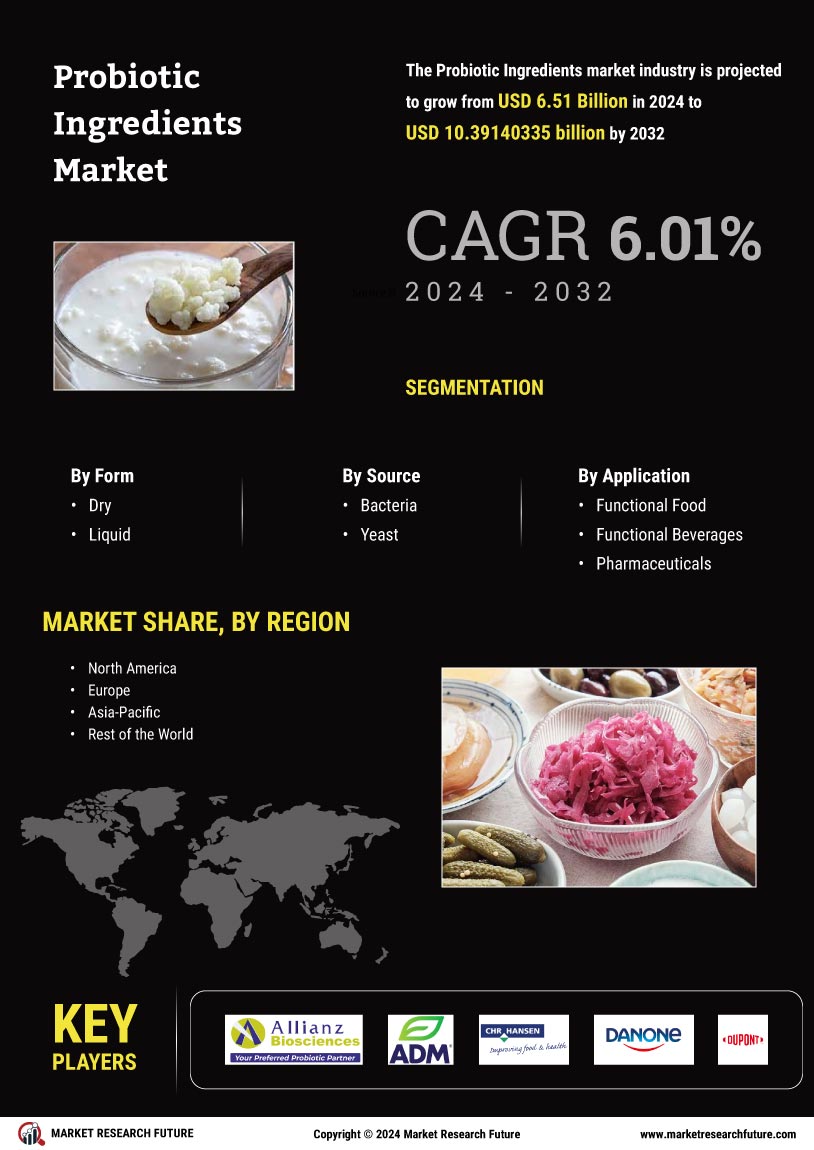

Growing Awareness of Gut Health

The increasing awareness of gut health among consumers appears to be a primary driver for the Probiotic Ingredients Market. As individuals become more informed about the connection between gut microbiota and overall health, the demand for probiotic ingredients is likely to rise. Research indicates that a healthy gut microbiome can influence various health aspects, including digestion, immunity, and mental well-being. This awareness is reflected in the growing number of products containing probiotics, with the market projected to reach substantial figures in the coming years. The Probiotic Ingredients Market is thus experiencing a surge in interest, as consumers actively seek products that promote gut health and wellness.

Rising Popularity of Plant-Based Products

The trend towards plant-based diets is gaining momentum, which is influencing the Probiotic Ingredients Market. As consumers increasingly adopt vegetarian and vegan lifestyles, there is a growing demand for plant-based probiotic sources. This shift is supported by research indicating that plant-based diets can enhance gut health and overall well-being. The market for plant-based probiotic products is projected to grow significantly, with many companies innovating to create new formulations that cater to this demographic. The Probiotic Ingredients Market is thus adapting to these changes, as manufacturers explore diverse sources of probiotics derived from plants to meet the evolving preferences of health-conscious consumers.

Expansion of the Dietary Supplements Sector

The dietary supplements sector is witnessing notable expansion, which significantly impacts the Probiotic Ingredients Market. With a growing number of consumers turning to supplements for health benefits, the demand for probiotic ingredients is expected to increase. Market data suggests that the dietary supplements segment is projected to grow at a compound annual growth rate (CAGR) of over 8% in the next few years. This growth is driven by the rising prevalence of lifestyle-related health issues and the desire for preventive healthcare solutions. Consequently, the Probiotic Ingredients Market is likely to benefit from this trend, as manufacturers incorporate probiotics into various supplement formulations to meet consumer needs.

Increasing Regulatory Support for Probiotics

The increasing regulatory support for probiotics is emerging as a significant driver for the Probiotic Ingredients Market. Regulatory bodies are beginning to recognize the health benefits associated with probiotics, leading to clearer guidelines and standards for their use in food and supplements. This regulatory clarity is likely to encourage manufacturers to invest in probiotic products, knowing that they can meet compliance requirements. Furthermore, as more products receive regulatory approval, consumer trust in probiotics is expected to grow. Consequently, the Probiotic Ingredients Market stands to benefit from this supportive regulatory environment, which may facilitate market expansion and innovation.

Technological Advancements in Probiotic Formulations

Technological advancements in probiotic formulations are playing a crucial role in shaping the Probiotic Ingredients Market. Innovations in encapsulation techniques and delivery systems are enhancing the stability and efficacy of probiotic ingredients. These advancements allow for improved shelf life and bioavailability, making probiotics more appealing to consumers. Market analysis indicates that companies investing in research and development are likely to gain a competitive edge, as they can offer superior products that meet consumer expectations. As a result, the Probiotic Ingredients Market is expected to witness growth driven by these technological innovations, which facilitate the development of more effective probiotic solutions.