Market Analysis

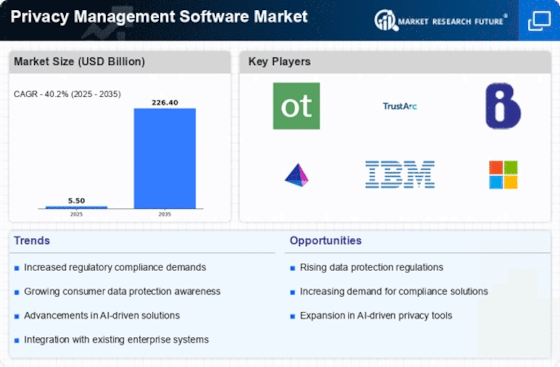

Privacy Management Software Market (Global, 2022)

Introduction

In recent years the privacy management software market has developed into a critical sector in response to the increasing complexities surrounding data privacy and regulatory compliance. As organizations of all sizes across all industries grapple with the challenge of protecting sensitive data, the demand for robust privacy management solutions has soared. These solutions not only help companies meet the requirements of the most stringent privacy regulations, but also enable them to manage and mitigate privacy risks effectively. As a result, companies are increasingly focusing on deploying comprehensive privacy strategies and investing in solutions that automate compliance processes, improve data governance and increase transparency. These solutions range from simple, stand-alone tools to more comprehensive, integrated data management platforms, reflecting the evolving needs of organizations striving to protect their reputations and maintain trust in an increasingly data-driven world.

PESTLE Analysis

- Political

- In 2022, the political climate surrounding privacy management software was largely shaped by the implementation of various data protection laws in different regions. The European Union's General Data Protection Regulation, for example, imposed a fine of up to 20 million or four percent of the company's annual turnover, whichever was higher, for each data breach. The resulting increase in the demand for privacy management solutions was due to the fact that companies were investing in privacy management solutions to avoid the fines. Furthermore, the United States had introduced state-level data protection laws, with the Californian Consumer Privacy Act affecting more than 500,000 companies, which in turn influenced the demand for privacy management solutions.

- Economic

- The economic factors influencing the privacy management software market in 2022 included the increasing costs associated with data breaches and non-compliance. According to a study, the average cost of a data breach in the United States was $ 4,240,000 in the first quarter of 2018. In addition, the spending on cyber-security is expected to exceed $ 150 billion in 2022, with a large part of it directed to privacy management tools. This economic pressure has led to an increase in the investment in tools that help reduce risks and ensure compliance with changing regulations.

- Social

- In 2022, the trend of the attitude of the public towards the protection of their privacy will have become very marked. The proportion of people who are concerned about how companies use their personal data will be seventy-nine per cent. Hence the growing demand for greater transparency and accountability from companies, who will be obliged to adopt privacy management software to improve their data protection practices. Social media and digital communications have also made people more aware of their rights to privacy, and this will make it even more necessary for companies to implement privacy management solutions if they are to maintain customer trust and loyalty.

- Technological

- IT-driven developments have played a major role in shaping the privacy management software market by 2022. Artificial intelligence and machine learning have been integrated into the privacy management tools, enabling companies to automate compliance processes and enhance their data protection measures. By 2022, it is estimated that 30% of the privacy management software solutions will be equipped with AI-driven features, which will enable real-time monitoring and risk assessment. Moreover, the growing adoption of cloud-based solutions has eased the access to the privacy management tools. Over 60% of the organizations are currently using cloud services for their data management needs.

- Legal

- In recent years, the legal framework for data privacy has become more complex, with a large number of regulations being enacted worldwide. In 2022, more than 100 countries had implemented or were in the process of implementing data privacy legislation, thereby creating a difficult environment for companies. In 2023, the Californian Data Protection Act, which complemented the CCPA, was to enter into force, affecting thousands of companies that had their seat in California. These legal developments have led companies to seek out privacy management systems that help them to comply with the various regulations and avoid legal repercussions.

- Environmental

- The environment may not be the main focus of the development of privacy-protection software, but the tech industry is becoming more and more interested in this subject. By 2022, some 45 percent of the companies in the industry had reported that they were reducing their carbon footprint, with energy-efficient data centers and sustainable software development. The use of privacy-protection software is also expected to be aligned with the goals of the sustainability movement. This will affect both the product portfolio and the strategy of the companies.

Porter's Five Forces

- Threat of New Entrants

- The entry barriers to the market for privacy management solutions are medium due to the need for specialized knowledge of data protection regulations and technology. The demand for privacy solutions is growing, but in order to compete successfully, new entrants must invest heavily in technology and compliance. The established companies have strong brand awareness and customer loyalty, which may deter new entrants.

- Bargaining Power of Suppliers

- The bargaining power of suppliers in the Privacy Management Software market is relatively low. There are many different software vendors and technology vendors in the market, so it is easy for companies to switch suppliers if they so choose. Also, many of the software solutions are based on broadly available technology, which further reduces the bargaining power of suppliers and makes it easier for companies to negotiate favorable terms.

- Bargaining Power of Buyers

- The bargaining power of buyers in the Data Protection Management Software Market is high due to the growing number of solutions available and the critical importance of data protection. Moreover, buyers have more choice in vendors, which gives them more power in negotiations. As regulations become stricter, buyers are more inclined to seek the best value for their investment in data protection management.

- Threat of Substitutes

- The threat of substitutes in the Data Management Software market is moderate. Manually operated procedures and generic software tools are alternatives, but they do not provide the same level of efficiency and effectiveness as dedicated data management tools. However, as technology develops, new substitutes may emerge and the threat of substitutes may grow over time.

- Competitive Rivalry

- Competition is high in the market for privacy management software. The fast-growing market has attracted established companies as well as new entrants. Competition is intensified by the constant innovation and development of new products to establish a competitive advantage. Price competition is also intense as companies try to lure customers in a crowded marketplace.

SWOT Analysis

Strengths

- Growing demand for data protection and privacy compliance due to increasing regulations.

- Ability to automate and streamline privacy management processes for organizations.

- Enhanced customer trust and brand reputation through effective privacy management.

Weaknesses

- High initial investment costs for implementation and integration.

- Complexity in adapting to various regulatory requirements across different regions.

- Potential resistance from employees due to changes in data handling practices.

Opportunities

- Expansion into emerging markets with increasing data privacy concerns.

- Integration with other enterprise software solutions to enhance functionality.

- Development of AI-driven tools for predictive privacy risk management.

Threats

- Rapidly evolving regulatory landscape may lead to compliance challenges.

- Increased competition from new entrants and established tech companies.

- Potential data breaches that could undermine the effectiveness of privacy management solutions.

Summary

Hence, the demand for privacy management solutions is expected to be strong in 2022, driven by the increasing regulatory requirements and the need to enhance data security measures. In spite of the high costs of implementation and the complexity of the regulations, the market is expected to grow, especially in emerging markets and through the development of technology. Nevertheless, companies will have to beware of competition and the risk of data breaches that could harm their reputation.

Leave a Comment