Focus on Personalized Medicine

The shift towards personalized medicine is emerging as a key driver in the Japan precision medical devices market. As healthcare becomes increasingly tailored to individual patient needs, there is a growing demand for precision medical devices that can deliver customized treatment options. This trend is particularly relevant in oncology, where precision therapies are becoming more prevalent. The market for personalized medical devices in Japan is expected to expand, with projections indicating a growth rate of around 15% annually. This focus on personalized approaches not only enhances treatment efficacy but also aligns with the broader goals of improving patient outcomes, thereby reinforcing the growth trajectory of the Japan precision medical devices market.

Increasing Healthcare Expenditure

Healthcare expenditure in Japan is on the rise, which is significantly impacting the Japan precision medical devices market. As the government allocates more resources to healthcare, there is a corresponding increase in the demand for advanced medical technologies. In 2025, Japan's healthcare spending is projected to reach approximately 500 billion USD, reflecting a growing commitment to improving healthcare services. This increase in expenditure is likely to facilitate the adoption of precision medical devices, as healthcare providers seek to enhance patient care and operational efficiency. Consequently, the Japan precision medical devices market stands to benefit from this upward trend in healthcare investment.

Government Initiatives and Support

The Japan precision medical devices market benefits from robust government initiatives aimed at fostering innovation and growth. The Japanese government has implemented various policies to support research and development in the medical technology sector. For example, the 'Healthcare Innovation Strategy' aims to promote the development of cutting-edge medical devices and technologies. Additionally, the government provides financial incentives and grants to companies engaged in the development of precision medical devices. This supportive regulatory environment is likely to encourage both domestic and foreign investments in the Japan precision medical devices market, further enhancing its growth potential.

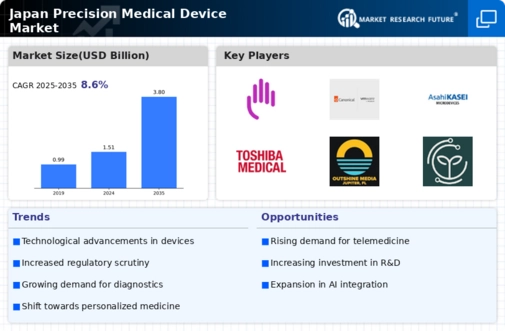

Technological Advancements in Medical Devices

Technological advancements are playing a pivotal role in shaping the Japan precision medical devices market. Innovations such as artificial intelligence, machine learning, and advanced imaging techniques are revolutionizing the way medical devices are designed and utilized. For instance, the introduction of AI-driven diagnostic tools is enhancing the accuracy of disease detection, which is crucial in a country with a high prevalence of chronic diseases. The market for AI-based medical devices in Japan is expected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. These technological improvements not only enhance patient outcomes but also streamline healthcare processes, thereby driving the overall growth of the Japan precision medical devices market.

Rising Demand for Minimally Invasive Procedures

The Japan precision medical devices market is experiencing a notable increase in demand for minimally invasive procedures. This trend is largely driven by the growing preference among patients for surgeries that entail less pain, reduced recovery time, and minimal scarring. According to recent data, the market for minimally invasive surgical devices in Japan is projected to reach approximately 1.5 billion USD by 2026. This shift towards less invasive techniques is prompting manufacturers to innovate and develop advanced precision medical devices that cater to this demand. Furthermore, the integration of robotics and imaging technologies into surgical procedures is enhancing the efficacy and safety of these interventions, thereby further propelling the growth of the Japan precision medical devices market.