Regulatory Support and Compliance

The France precision medical devices market benefits from a robust regulatory framework that ensures safety and efficacy. The French National Agency for the Safety of Medicines and Health Products (ANSM) plays a pivotal role in overseeing the approval and monitoring of medical devices. This regulatory support fosters innovation while ensuring that products meet stringent safety standards. In 2025, the market witnessed a surge in new device approvals, with over 200 devices receiving certification, reflecting the industry's growth potential. The regulatory environment not only enhances consumer trust but also encourages manufacturers to invest in research and development, thereby driving the market forward.

Aging Population and Chronic Diseases

France's demographic trends indicate a growing aging population, which significantly impacts the precision medical devices market. As of 2025, approximately 20% of the French population is aged 65 and older, leading to an increased prevalence of chronic diseases such as diabetes and cardiovascular conditions. This demographic shift necessitates advanced medical devices tailored to manage these health issues effectively. The demand for precision devices, including monitoring systems and surgical instruments, is expected to rise, creating lucrative opportunities for manufacturers. Consequently, the aging population serves as a critical driver for innovation and market expansion in the France precision medical devices market.

Investment in Research and Development

Investment in research and development (R&D) is a crucial driver for the France precision medical devices market. The French government, alongside private sector stakeholders, has been actively promoting R&D initiatives to foster innovation in medical technology. In 2025, R&D expenditure in the medical device sector reached approximately 5 billion euros, reflecting a commitment to advancing precision healthcare solutions. This investment not only enhances the development of cutting-edge devices but also positions France as a leader in the global medical technology landscape. The focus on R&D is likely to yield breakthroughs in device functionality and patient outcomes, further propelling market growth.

Rising Health Awareness and Preventive Care

Rising health awareness among the French population is significantly influencing the precision medical devices market. As individuals become more proactive about their health, there is an increasing demand for devices that facilitate preventive care and early diagnosis. In 2025, the market for home monitoring devices, such as blood glucose monitors and wearable health trackers, is expected to expand by 20%. This trend reflects a shift towards personalized healthcare solutions that empower patients to take control of their health. Consequently, the growing emphasis on preventive care is likely to drive innovation and market growth within the France precision medical devices market.

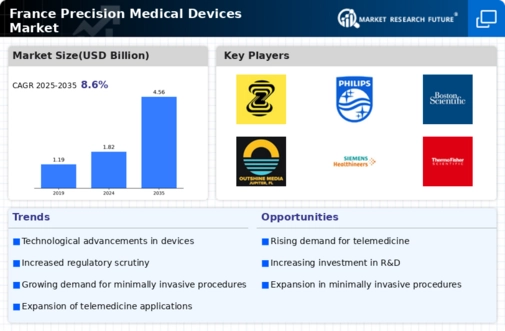

Technological Advancements in Medical Devices

Technological advancements are reshaping the France precision medical devices market, driving demand for innovative solutions. The integration of artificial intelligence, robotics, and telemedicine into medical devices has revolutionized patient care and diagnostics. In 2025, the market for AI-driven medical devices is projected to grow by 15%, indicating a strong trend towards automation and enhanced precision. These advancements not only improve the accuracy of diagnoses but also streamline surgical procedures, leading to better patient outcomes. As technology continues to evolve, the France precision medical devices market is likely to experience sustained growth, fueled by the demand for smarter, more efficient devices.