Increasing Health Consciousness

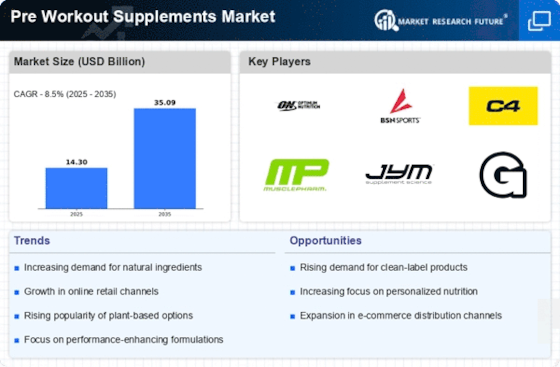

The Pre Workout Supplements Market is experiencing a notable surge in demand, driven by a growing awareness of health and fitness among consumers. Individuals are increasingly prioritizing their physical well-being, leading to a rise in the consumption of supplements that enhance workout performance. According to recent data, the market is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This trend indicates that consumers are not only seeking to improve their athletic performance but are also becoming more discerning about the ingredients in their supplements. As a result, brands that emphasize transparency and quality in their formulations are likely to gain a competitive edge in the Pre Workout Supplements Market.

Rising Popularity of E-commerce

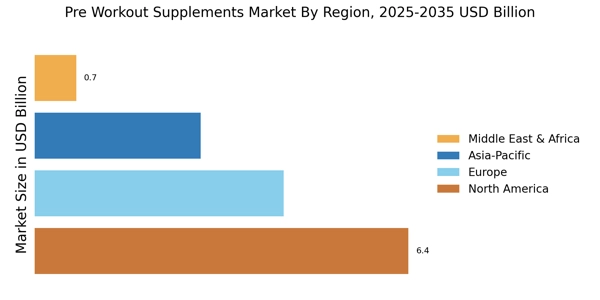

The rise of e-commerce platforms is transforming the way consumers purchase products in the Pre Workout Supplements Market. With the convenience of online shopping, consumers are increasingly turning to digital channels to access a wider variety of supplements. Recent reports indicate that online sales of dietary supplements have surged, accounting for nearly 30% of total sales in the industry. This shift not only allows consumers to compare products easily but also provides brands with the opportunity to reach a global audience. As e-commerce continues to grow, companies that optimize their online presence and marketing strategies are likely to benefit significantly in the Pre Workout Supplements Market.

Innovations in Product Formulation

Innovations in product formulation are playing a crucial role in shaping the Pre Workout Supplements Market. Manufacturers are increasingly focusing on developing unique blends of ingredients that cater to specific consumer needs, such as energy enhancement, endurance, and recovery. The introduction of plant-based and natural ingredients is also gaining traction, appealing to a broader audience that seeks cleaner alternatives. Market data suggests that products featuring innovative formulations are likely to capture a larger share of the market, as consumers become more educated about the benefits of various ingredients. This trend indicates that companies that invest in research and development to create effective and appealing products will thrive in the competitive landscape of the Pre Workout Supplements Market.

Expansion of Fitness Centers and Gyms

The proliferation of fitness centers and gyms is significantly influencing the Pre Workout Supplements Market. As more individuals engage in regular exercise routines, the demand for pre workout supplements is expected to rise correspondingly. Recent statistics indicate that the number of fitness facilities has increased by over 20% in the past three years, creating a larger consumer base for these products. This expansion not only provides consumers with greater access to fitness resources but also fosters a culture of fitness that encourages the use of supplements to enhance workout efficacy. Consequently, brands that align their marketing strategies with this growing fitness culture may find substantial opportunities within the Pre Workout Supplements Market.

Influence of Social Media and Fitness Influencers

The influence of social media and fitness influencers is a driving force in the Pre Workout Supplements Market. As consumers increasingly rely on social media for fitness inspiration and product recommendations, brands are leveraging influencer partnerships to enhance their visibility and credibility. Data suggests that nearly 70% of consumers are more likely to purchase a product endorsed by a fitness influencer they follow. This trend highlights the importance of digital marketing strategies that engage consumers through authentic and relatable content. Brands that effectively collaborate with influencers to promote their pre workout supplements may experience accelerated growth and brand loyalty within the Pre Workout Supplements Market.