Pre Workout Supplements Size

Pre Workout Supplements Market Growth Projections and Opportunities

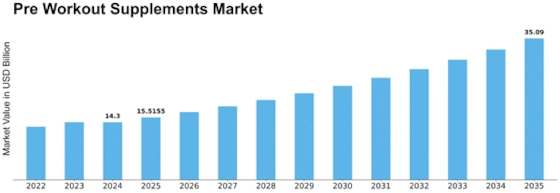

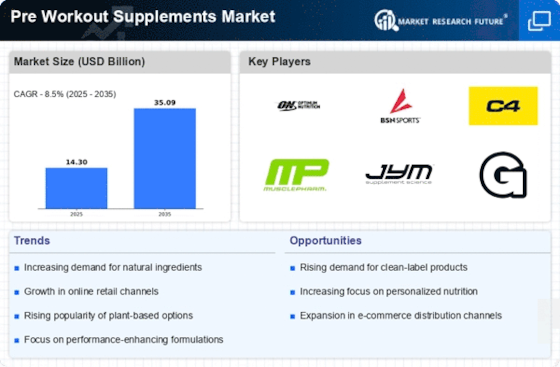

The market has experienced a lot of hype on Pre-Workout Supplements, and this is a result of several market factors that address the changing tastes and desires of health-oriented consumers. One of the main reasons for the continuous growth in demand for pre-workout supplements is that people are becoming more concerned about their health and fitness. By 2022, the Pre-Workout Supplements market had hit USD 13.2 billion in terms of worth, which makes it one of the markets to watch out for any investment in the future. The industry is expected to register a remarkable increase from USD 14.3 billion in 2023 to an impressive USD 27.5 billion by 2032, as forecasts have indicated. This reflects an attractive growth rate at CAGR (Compound Annual Growth Rate), which means that it will grow by around 8.50% over the next decade and after. Growing awareness of fitness and wellness has driven up demand for Pre-Workout Supplements, leading many people to include them in their exercise routines. Considering that consumers' preferences continue to focus on their health, there will be great opportunities for expansion in The Pre-Workout Supplements Market due to its current trends in lifestyle choices globally. Besides, owing to a shift in demographics whereby there is increased participation across all age groups, people's preference for pre-workout supplements continues to rise day by day. "Additionally, the quick pace urbanization as well as consequent sedentary lifestyles have caused more awareness regarding physical activity." To avoid or prevent themselves from experiencing some adverse effects, they may require regular exercise like walking rather than lying in bed and doing nothing. Further still, various media outlets have played significant roles in persuading individuals to use pre-workout supplements, mainly via the provision of information and education on health and fitness. Secondly, today's informed customers are capable of selecting their preferred Pre-Workout supplements because relevant details concerning constituent ingredients and composition are available from various sources. Among other fitness trends, social media has had the most significant impact on people's lifestyles. They usually share their workout routines and supplement choices on platforms like Instagram and YouTube. Also, pre-workout supplements' taste and ease have become vital market elements. Manufacturers have responded to customer preferences by developing different flavors and convenient packaging, such as single-serve packets or ready-to-drink forms.

Leave a Comment