Rising Focus on Customer Experience

The POS Machine Market is increasingly driven by a rising focus on enhancing customer experience. Businesses are recognizing that efficient and user-friendly POS systems can significantly impact customer satisfaction and loyalty. As a result, there is a growing trend towards investing in POS solutions that offer features such as personalized promotions, loyalty programs, and real-time analytics. Data suggests that companies that prioritize customer experience can achieve up to 60% higher profitability. This emphasis on customer-centric solutions is likely to propel the growth of the POS Machine Market, as businesses seek to differentiate themselves in a competitive marketplace.

Technological Advancements in POS Systems

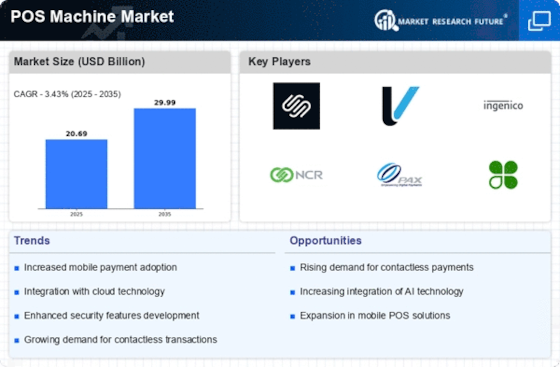

The POS Machine Market is witnessing rapid technological advancements that are reshaping the landscape of payment processing. Innovations such as cloud-based POS systems, artificial intelligence, and machine learning are enhancing the functionality and efficiency of POS devices. These technologies enable businesses to analyze customer data, optimize inventory management, and improve overall service delivery. As organizations increasingly adopt these advanced solutions, the POS Machine Market is expected to experience significant growth, with projections indicating a compound annual growth rate of around 10% over the next five years.

Increasing Demand for Contactless Payments

The POS Machine Market is experiencing a notable surge in demand for contactless payment solutions. This trend is driven by consumer preferences for convenience and speed during transactions. According to recent data, contactless payments accounted for approximately 30% of all card transactions in 2025, reflecting a significant shift in payment behavior. Retailers are increasingly adopting POS systems that support contactless technology to enhance customer experience and streamline operations. As a result, the POS Machine Market is likely to see a continued rise in the adoption of contactless-enabled devices, which may further drive revenue growth and market expansion.

Growth of E-commerce and Omnichannel Retailing

The POS Machine Market is significantly influenced by the growth of e-commerce and the rise of omnichannel retailing strategies. As businesses strive to provide seamless shopping experiences across various platforms, the demand for integrated POS systems that can handle both in-store and online transactions is increasing. Data indicates that e-commerce sales have grown by over 20% annually, prompting retailers to invest in advanced POS solutions that facilitate inventory management and customer engagement. This trend suggests that the POS Machine Market will continue to evolve, adapting to the needs of a more interconnected retail environment.

Expansion of Small and Medium Enterprises (SMEs)

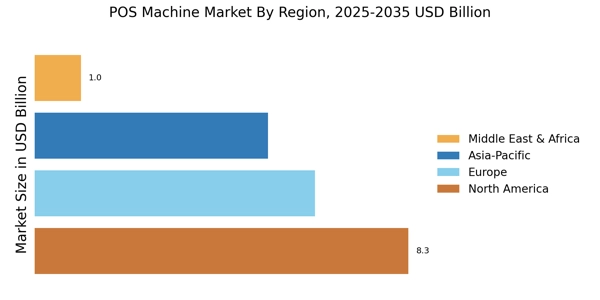

The POS Machine Market is benefiting from the expansion of small and medium enterprises (SMEs) across various sectors. SMEs are increasingly recognizing the importance of efficient payment processing systems to enhance operational efficiency and customer satisfaction. Recent statistics show that SMEs contribute to over 60% of employment in many regions, indicating a robust market for POS solutions tailored to their needs. As these businesses seek to modernize their payment systems, the demand for affordable and user-friendly POS machines is likely to rise, thereby driving growth within the POS Machine Market.