Polyphenol Size

Polyphenol Market Growth Projections and Opportunities

The polyphenol market is influenced by various market factors that contribute to its growth and dynamics. One crucial factor is the increasing awareness and demand for healthy dietary supplements and functional foods. Consumers are becoming more conscious of their health and are seeking products that offer potential health benefits. Polyphenols, known for their antioxidant properties and potential health-promoting effects, have gained attention in the market as natural compounds with various health benefits.

Additionally, the rising prevalence of chronic diseases and lifestyle-related health issues has propelled the demand for polyphenol-rich products. Consumers are actively looking for natural solutions to support their well-being, and polyphenols, found in fruits, vegetables, tea, and other sources, are considered valuable contributors to health and disease prevention. This health-conscious trend is a significant market driver for polyphenols.

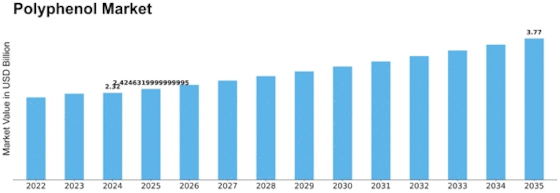

Polyphenol Market Size was valued at USD 2.1 Billion in 2022. The Polyphenol industry is projected to grow from USD 2.2 Billion in 2023 to USD 3.3 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.2%

Another key market factor is the expanding application of polyphenols in diverse industries. Beyond the traditional food and beverage sector, polyphenols find applications in pharmaceuticals, cosmetics, and nutraceuticals. The versatility of polyphenols as functional ingredients has led to their incorporation into a wide range of products, including dietary supplements, skincare products, and pharmaceutical formulations. This diversification of applications contributes to the overall growth of the polyphenol market.

The global shift towards sustainable and organic products is also influencing the polyphenol market. Consumers are increasingly seeking natural and organic options, and polyphenols, being naturally occurring compounds in plants, align with this preference. The demand for organic and sustainably sourced polyphenols has led to the development of eco-friendly extraction methods and farming practices, reflecting the growing importance of sustainability in the polyphenol market.

Market factors are also influenced by ongoing research and development activities in the field of polyphenols. Scientific studies exploring the health benefits and potential therapeutic applications of polyphenols contribute to the market's growth. As more evidence emerges regarding the positive effects of polyphenols on various health conditions, consumer confidence in these products increases, further driving market expansion.

Globalization and international trade play a vital role in shaping the polyphenol market. The accessibility of polyphenol-rich raw materials from different regions allows manufacturers to source ingredients globally, contributing to product innovation and market competitiveness. Additionally, the adoption of polyphenol-rich diets in various cultures worldwide further fuels the demand for polyphenol-containing products.

Market factors are also influenced by regulatory developments and standards. As the demand for polyphenols rises, regulatory bodies are establishing guidelines for their use in different industries. Clear regulations provide a framework for manufacturers, ensuring the quality and safety of polyphenol-containing products. This regulatory landscape shapes the market by influencing product formulations, labeling, and marketing practices.

Leave a Comment