Consumer Awareness

The growing awareness among consumers regarding environmental issues is driving the Polyethylene Furanoate Market. As individuals become more informed about the detrimental effects of traditional plastics, there is a noticeable shift towards products made from sustainable materials. This heightened awareness is prompting manufacturers to explore alternatives like polyethylene furanoate, which aligns with consumer preferences for eco-friendly options. Market Research Future indicates that a significant percentage of consumers are willing to pay a premium for sustainable products, suggesting that the Polyethylene Furanoate Market could see substantial growth as brands respond to this demand.

Regulatory Support

Government regulations promoting the use of biodegradable materials are influencing the Polyethylene Furanoate Market positively. Many countries are implementing stricter regulations on single-use plastics, thereby creating a favorable environment for bioplastics. For instance, policies that incentivize the use of renewable materials are likely to drive demand for polyethylene furanoate. As of October 2025, the Polyethylene Furanoate Market is benefiting from these regulatory frameworks, which not only encourage innovation but also provide financial support for companies transitioning to sustainable materials. This regulatory landscape may significantly impact market dynamics in the coming years.

Technological Innovations

Technological advancements in the production processes of polyethylene furanoate are likely to enhance its market viability. Innovations such as improved catalytic processes and fermentation techniques are being developed to increase yield and reduce production costs. These advancements could potentially lower the price point of polyethylene furanoate, making it more accessible to a broader range of industries. As of October 2025, the Polyethylene Furanoate Market is witnessing a shift towards more efficient manufacturing methods, which may lead to increased adoption across sectors such as packaging and textiles. This evolution in technology is expected to play a crucial role in shaping the future landscape of the market.

Sustainability Initiatives

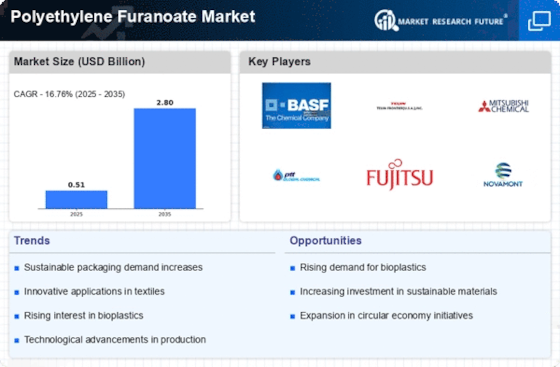

The increasing emphasis on sustainability appears to be a pivotal driver for the Polyethylene Furanoate Market. As consumers and corporations alike prioritize eco-friendly materials, the demand for biodegradable alternatives to conventional plastics is surging. Polyethylene furanoate, derived from renewable resources, presents a compelling solution. Recent data indicates that the market for bioplastics, including polyethylene furanoate, is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This trend suggests that companies investing in sustainable practices may gain a competitive edge, thereby propelling the Polyethylene Furanoate Market forward.

Diverse Application Potential

The versatility of polyethylene furanoate is emerging as a key driver for its market expansion. This biopolymer can be utilized in various applications, including packaging, textiles, and automotive components. Its unique properties, such as high thermal stability and barrier performance, make it suitable for a wide range of products. As industries increasingly seek sustainable alternatives, the Polyethylene Furanoate Market is likely to benefit from this diverse application potential. Current trends indicate that sectors such as food packaging are particularly interested in adopting polyethylene furanoate, which may lead to increased market penetration and growth.