Plastic Waste Management Market Summary

As per Market Research Future analysis, the Global Plastic Waste Management Market Size was estimated at 31.89 USD Billion in 2024. The Plastic Waste Management industry is projected to grow from 33.22 USD Billion in 2025 to 49.98 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.17% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Plastic Waste Management Market is poised for substantial growth driven by technological advancements and increasing regulatory pressures.

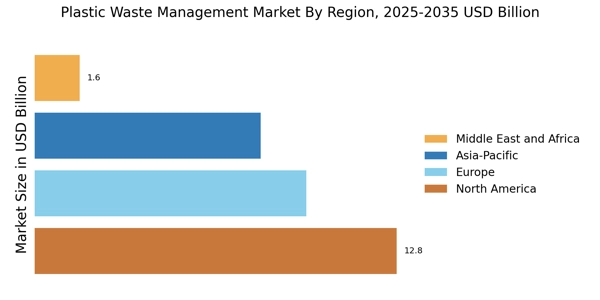

- Technological advancements in recycling are reshaping the landscape of plastic waste management, particularly in North America.

- Consumer awareness and behavioral change are becoming pivotal in driving demand for sustainable waste management solutions in the Asia-Pacific region.

- Kerbside collection remains the largest segment, while curbside recycling is emerging as the fastest-growing segment in the market.

- Rising environmental concerns and stringent regulatory policies are key drivers propelling the growth of the plastic waste management market.

Market Size & Forecast

| 2024 Market Size | 31.89 (USD Billion) |

| 2035 Market Size | 49.98 (USD Billion) |

| CAGR (2025 - 2035) | 4.17% |

Major Players

Veolia (FR), SUEZ (FR), Waste Management (US), Republic Services (US), Biffa (GB), Clean Harbors (US), Stericycle (US), Remondis (DE), FCC Environment (GB), Covanta (US)