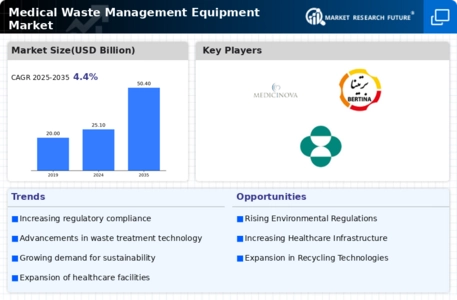

Market Growth Projections

The Global Medical Waste Management Equipment Market Industry is poised for substantial growth, with projections indicating a market value of 25.1 USD Billion in 2024 and an anticipated increase to 50.4 USD Billion by 2035. This growth trajectory is underpinned by a compound annual growth rate (CAGR) of 6.56% from 2025 to 2035. The increasing demand for effective waste management solutions, driven by healthcare expansion, regulatory pressures, and technological advancements, suggests a dynamic market landscape. These projections highlight the importance of investing in innovative medical waste management equipment to meet evolving healthcare needs.

Technological Advancements

Technological advancements play a pivotal role in shaping the Global Medical Waste Management Equipment Market Industry. Innovations in waste treatment technologies, such as autoclaving and microwave treatment, are enhancing the efficiency and effectiveness of waste management processes. These technologies not only reduce the volume of waste but also minimize environmental impact. As healthcare facilities adopt these advanced solutions, the demand for modern medical waste management equipment is likely to surge. The integration of smart technologies, such as IoT and automation, further streamlines waste management operations, making it a key driver of market growth.

Stringent Regulatory Frameworks

The Global Medical Waste Management Equipment Market Industry is influenced by stringent regulatory frameworks that govern waste disposal practices. Governments worldwide are implementing rigorous regulations to ensure the safe and environmentally responsible disposal of medical waste. These regulations often mandate the use of specialized equipment for waste segregation, treatment, and disposal. As compliance becomes increasingly critical, healthcare facilities are compelled to invest in advanced medical waste management equipment. This regulatory pressure is expected to drive market growth, as facilities seek to avoid penalties and enhance their operational standards.

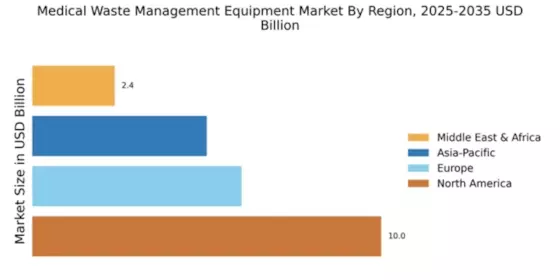

Increasing Healthcare Expenditure

The Global Medical Waste Management Equipment Market Industry is experiencing growth driven by rising healthcare expenditures across various nations. Governments and private sectors are investing significantly in healthcare infrastructure, which includes the procurement of advanced medical waste management equipment. For instance, healthcare spending is projected to reach 25.1 USD Billion in 2024, reflecting a growing recognition of the importance of effective waste management in healthcare settings. This trend is likely to continue as countries strive to improve their healthcare systems, thereby increasing the demand for efficient waste management solutions.

Rising Incidence of Infectious Diseases

The Global Medical Waste Management Equipment Market Industry is also driven by the rising incidence of infectious diseases, which generates a higher volume of medical waste. As healthcare facilities respond to increasing patient loads, particularly in regions experiencing outbreaks, the demand for effective waste management solutions intensifies. This scenario necessitates the acquisition of specialized medical waste management equipment to ensure safe disposal practices. The market is projected to reach 50.4 USD Billion by 2035, indicating a robust growth trajectory fueled by the need for efficient waste management in the face of public health challenges.

Growing Awareness of Environmental Sustainability

The Global Medical Waste Management Equipment Market Industry is witnessing a surge in demand due to growing awareness of environmental sustainability. Healthcare providers are increasingly recognizing the importance of responsible waste management practices to mitigate their environmental footprint. This shift in mindset is prompting facilities to invest in eco-friendly waste management solutions. As a result, the market for medical waste management equipment is expected to expand, with an anticipated growth rate of 6.56% from 2025 to 2035. This trend reflects a broader societal movement towards sustainability and responsible resource management.