Shift Towards Plant-based Diets

The global shift towards plant-based diets is influencing the Plant-based Feed Enzyme Market in various ways. As consumers increasingly adopt vegetarian and vegan lifestyles, there is a corresponding rise in the demand for plant-based protein sources in animal feed. This trend is prompting livestock producers to seek alternatives to traditional feed ingredients, thereby creating opportunities for plant-based feed enzymes. These enzymes facilitate the efficient utilization of plant proteins, making them a valuable addition to animal diets. The market is likely to benefit from this shift, as producers aim to align their practices with changing consumer preferences and dietary trends.

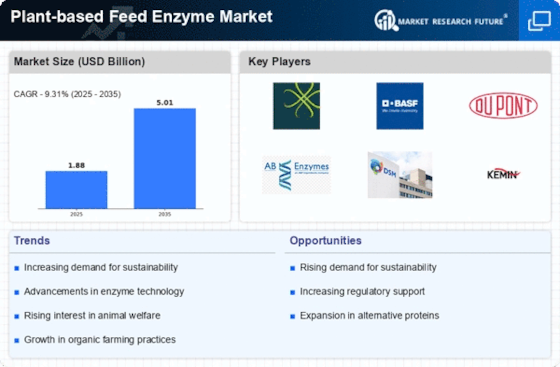

Rising Demand for Sustainable Animal Feed

The increasing emphasis on sustainability within the agricultural sector appears to drive the Plant-based Feed Enzyme Market. As consumers become more environmentally conscious, there is a notable shift towards sustainable animal feed solutions. This trend is reflected in the growing demand for plant-based feed enzymes, which are perceived as more eco-friendly alternatives to traditional animal feed additives. According to recent data, the market for plant-based feed enzymes is projected to grow at a compound annual growth rate of approximately 7% over the next five years. This growth is likely fueled by the need for sustainable practices in livestock production, which aligns with the broader goals of reducing carbon footprints and promoting animal welfare.

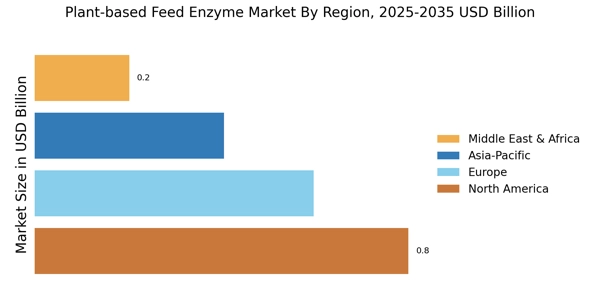

Regulatory Support for Plant-based Solutions

Regulatory frameworks increasingly favor the use of plant-based solutions in animal feed, which could significantly impact the Plant-based Feed Enzyme Market. Governments and regulatory bodies are implementing policies that encourage the adoption of plant-based feed additives, recognizing their potential benefits for both animal health and environmental sustainability. For instance, certain regions have introduced incentives for farmers who utilize plant-based feed enzymes, thereby enhancing their market appeal. This regulatory support is expected to bolster the market, as it not only legitimizes the use of these enzymes but also encourages research and development in this area. The anticipated growth in regulatory backing may lead to a more robust market environment for plant-based feed enzymes.

Technological Innovations in Enzyme Production

Technological advancements in enzyme production processes are likely to play a pivotal role in the Plant-based Feed Enzyme Market. Innovations such as fermentation technology and genetic engineering are enhancing the efficiency and efficacy of plant-based enzymes. These advancements not only improve the performance of feed enzymes but also reduce production costs, making them more accessible to livestock producers. As a result, the market is expected to witness an influx of new products that cater to diverse animal nutrition needs. The integration of technology in enzyme production could potentially lead to a market expansion, as producers seek to optimize feed formulations and improve overall animal health.

Growing Awareness of Animal Health and Nutrition

The increasing awareness regarding animal health and nutrition is driving the Plant-based Feed Enzyme Market. Livestock producers are becoming more informed about the benefits of incorporating plant-based feed enzymes into their feeding regimens. These enzymes are known to enhance nutrient digestibility, improve feed efficiency, and promote overall animal well-being. As a result, there is a growing trend among farmers to adopt these solutions to ensure optimal health and productivity of their livestock. Market data suggests that the demand for plant-based feed enzymes is expected to rise as more producers recognize the advantages of these additives in supporting animal health and performance.