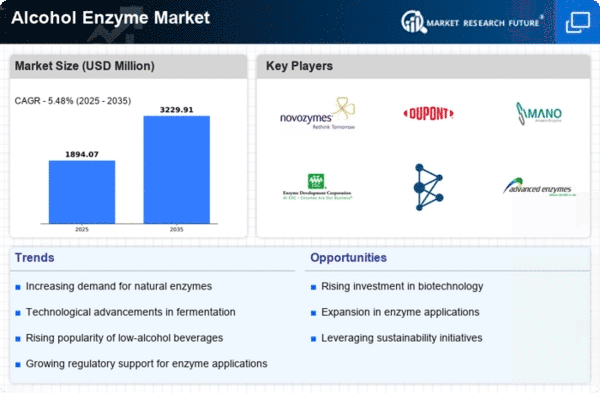

Market Growth Projections

The Global Alcohol Enzyme Market Industry is poised for substantial growth, with projections indicating a market value of 3.25 USD Billion in 2024 and an anticipated increase to 7.5 USD Billion by 2035. This growth reflects a compound annual growth rate of 7.9% from 2025 to 2035, driven by various factors including rising demand for alcoholic beverages, technological advancements, and health consciousness among consumers. The market dynamics suggest a robust future, with opportunities for innovation and expansion as producers seek to meet the evolving needs of consumers worldwide.

Health Consciousness Among Consumers

The growing health consciousness among consumers significantly influences the Global Alcohol Enzyme Market Industry. As individuals become more aware of the health implications of alcohol consumption, there is an increasing demand for low-calorie and low-sugar alcoholic beverages. Enzymes that facilitate the production of healthier options are becoming essential in meeting these consumer demands. This shift in consumer behavior is likely to drive innovation in enzyme applications, thereby expanding the market. The anticipated compound annual growth rate of 7.9% from 2025 to 2035 suggests that the industry will continue to adapt to these health trends.

Emerging Markets and Global Expansion

Emerging markets present significant opportunities for the Global Alcohol Enzyme Market Industry, as rising middle-class populations in regions such as Asia-Pacific and Latin America drive alcohol consumption. The increasing urbanization and changing lifestyles in these regions contribute to a growing demand for diverse alcoholic beverages. Enzymes that enhance fermentation and flavor profiles are essential for producers aiming to cater to these new markets. As the industry capitalizes on these opportunities, the market is projected to reach 3.25 USD Billion in 2024, with continued growth expected as producers adapt to local tastes and preferences.

Rising Demand for Alcoholic Beverages

The Global Alcohol Enzyme Market Industry experiences a notable surge in demand for alcoholic beverages, driven by changing consumer preferences and increasing disposable incomes. As more consumers seek premium and craft alcoholic products, the need for enzymes that enhance fermentation processes becomes apparent. This trend is reflected in the projected market value of 3.25 USD Billion in 2024, indicating a robust growth trajectory. The industry is likely to benefit from innovations in enzyme applications, which can improve flavor profiles and production efficiency, thus catering to the evolving tastes of consumers worldwide.

Regulatory Support for Enzyme Applications

Regulatory support for enzyme applications in the Global Alcohol Enzyme Market Industry is becoming increasingly favorable. Governments are recognizing the benefits of enzymes in enhancing food safety and quality, leading to more streamlined approval processes for enzyme products. This regulatory environment encourages innovation and investment in enzyme research and development, which is vital for the industry's growth. As regulations evolve, the market is expected to expand, with a projected value of 7.5 USD Billion by 2035, reflecting the positive impact of supportive policies on enzyme utilization in alcoholic beverage production.

Technological Advancements in Enzyme Production

Technological advancements play a crucial role in the Global Alcohol Enzyme Market Industry, as innovations in enzyme production and application are continuously emerging. Enhanced fermentation techniques and the development of genetically modified organisms for enzyme production are expected to increase efficiency and reduce costs. These advancements not only improve the quality of alcoholic beverages but also expand the range of products available to consumers. As the market evolves, the integration of these technologies is likely to contribute to the anticipated growth, with projections indicating a market size of 7.5 USD Billion by 2035.