Growth in the Electronics Sector

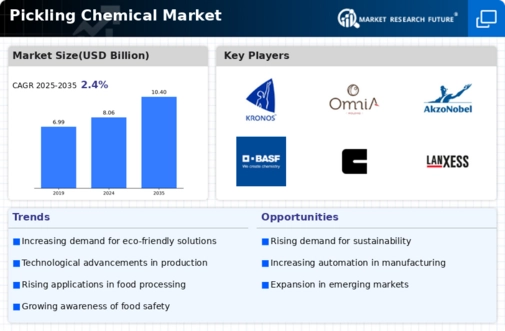

The electronics sector's expansion is significantly influencing the Pickling Chemical Market. As electronic devices become more sophisticated, the need for high-purity metals and components increases. Pickling chemicals play a crucial role in the production of electronic components by ensuring that metal surfaces are free from contaminants that could affect performance. The Pickling Chemical Market is projected to grow at a compound annual growth rate of around 5.2%, which suggests a corresponding increase in the demand for pickling chemicals. This growth is particularly evident in the production of semiconductors and circuit boards, where precision and cleanliness are paramount. Consequently, the Pickling Chemical Market is poised to benefit from this upward trend, as manufacturers prioritize quality and reliability in their products.

Rising Demand for Metal Surface Treatment

The increasing demand for metal surface treatment is a primary driver for the Pickling Chemical Market. Industries such as automotive, aerospace, and construction require effective surface preparation to enhance the durability and performance of metal components. The pickling process, which removes oxides and impurities from metal surfaces, is essential for ensuring optimal adhesion of coatings and finishes. As the automotive sector anticipates a growth rate of approximately 4.5% annually, the need for pickling chemicals is likely to rise correspondingly. Furthermore, the aerospace industry, with its stringent quality standards, also contributes to the demand for these chemicals. This trend indicates a robust market potential for the Pickling Chemical Market, as manufacturers seek to improve product quality and longevity.

Regulatory Compliance and Quality Standards

Regulatory compliance and stringent quality standards are pivotal drivers for the Pickling Chemical Market. Various industries, including food processing and pharmaceuticals, are subject to rigorous regulations that mandate the use of safe and effective cleaning agents. The pickling process not only enhances the quality of metal surfaces but also ensures compliance with health and safety regulations. For instance, the food industry requires that all equipment be free from contaminants, which necessitates the use of effective pickling chemicals. As regulatory bodies continue to enforce these standards, the demand for compliant pickling solutions is expected to rise. This trend underscores the importance of the Pickling Chemical Market in facilitating adherence to quality and safety regulations across multiple sectors.

Emergence of Eco-Friendly Pickling Solutions

The emergence of eco-friendly pickling solutions is reshaping the Pickling Chemical Market. As environmental concerns gain prominence, manufacturers are increasingly seeking sustainable alternatives to traditional pickling chemicals. These eco-friendly solutions not only reduce environmental impact but also align with corporate sustainability goals. The market for green chemicals is anticipated to grow significantly, with a projected increase of around 7% annually. This shift towards sustainability is likely to drive innovation within the Pickling Chemical Market, as companies invest in research and development to create effective, environmentally friendly products. The adoption of such solutions may also enhance brand reputation and customer loyalty, further propelling market growth.

Technological Innovations in Chemical Formulations

Technological innovations in chemical formulations are a key driver for the Pickling Chemical Market. Advances in chemical engineering and formulation technologies have led to the development of more effective and efficient pickling agents. These innovations not only improve the efficacy of the pickling process but also reduce the environmental footprint of these chemicals. For instance, the introduction of biodegradable pickling agents is gaining traction, as manufacturers seek to minimize waste and enhance sustainability. The market for advanced chemical formulations is expected to expand, with a growth rate of approximately 6% per year. This trend indicates that the Pickling Chemical Market is likely to experience significant transformation as companies adopt new technologies to meet evolving customer demands and regulatory requirements.