Stringent Environmental Regulations

The Boiler Water Treatment Chemical Market is significantly influenced by the implementation of stringent environmental regulations aimed at reducing water pollution and promoting sustainable practices. Governments and regulatory bodies are increasingly mandating the use of eco-friendly chemicals and processes in industrial operations. This regulatory landscape compels industries to adopt advanced boiler water treatment solutions that comply with environmental standards. The market for green chemicals is projected to expand, with a focus on reducing harmful emissions and waste. As a result, the Boiler Water Treatment Chemical Market is likely to witness a shift towards more sustainable products, aligning with global environmental goals.

Increasing Demand for Energy Efficiency

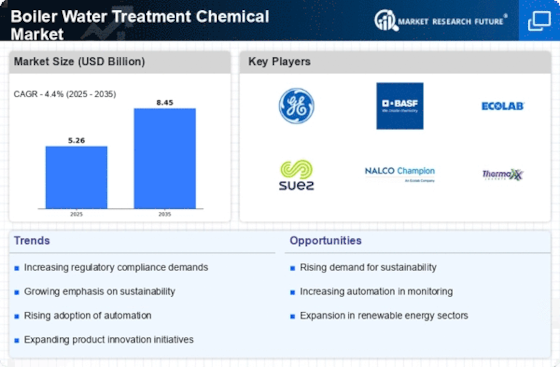

The Boiler Water Treatment Chemical Market is experiencing a notable surge in demand driven by the increasing emphasis on energy efficiency across various sectors. Industries are actively seeking ways to optimize their operations, reduce energy consumption, and minimize operational costs. The implementation of advanced boiler water treatment chemicals can enhance the efficiency of steam generation and heat transfer, thereby contributing to lower energy bills. According to recent data, the energy efficiency market is projected to grow significantly, with a compound annual growth rate (CAGR) of approximately 8% over the next few years. This trend indicates a robust opportunity for the Boiler Water Treatment Chemical Market to cater to the evolving needs of energy-conscious consumers.

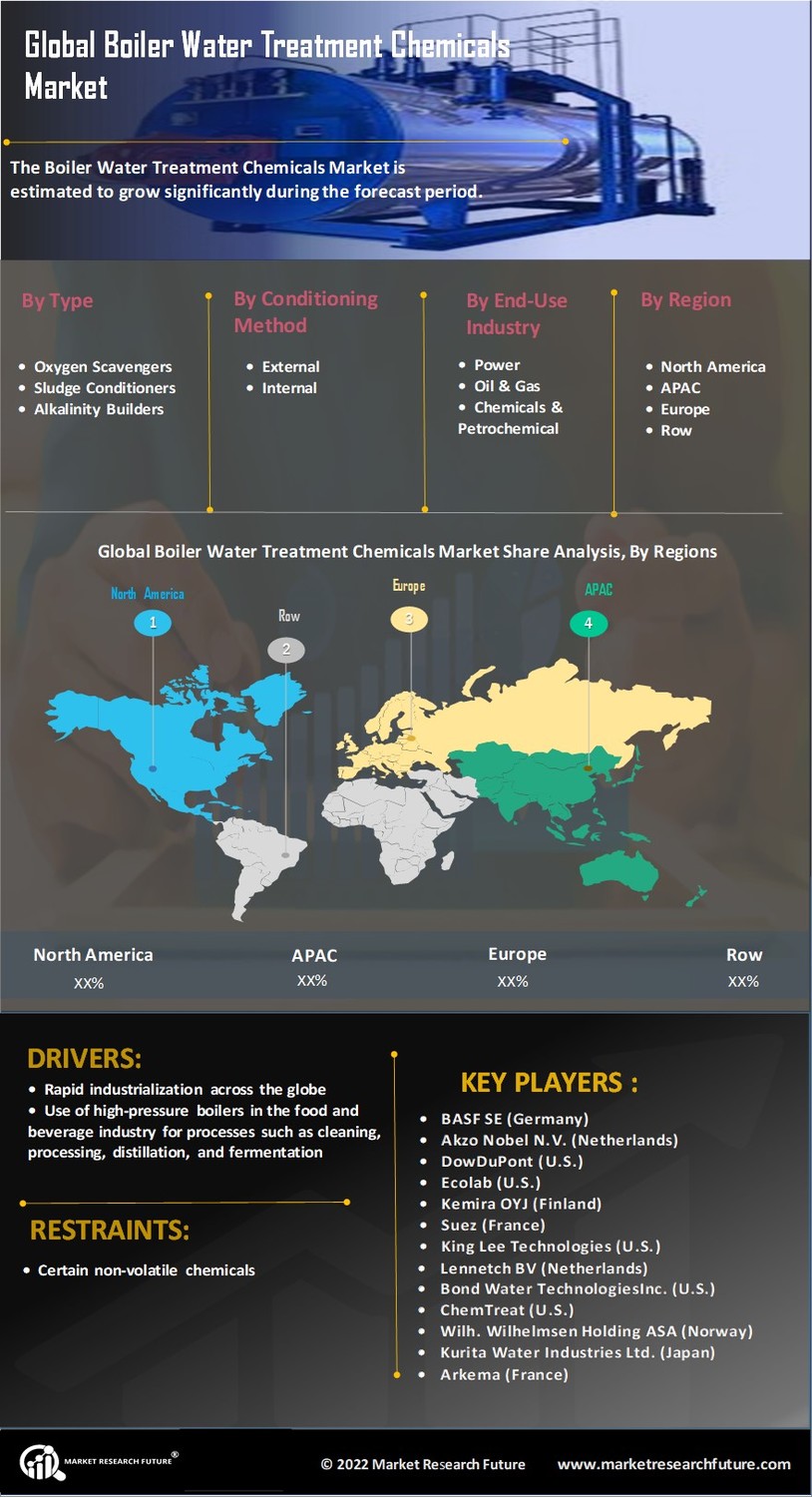

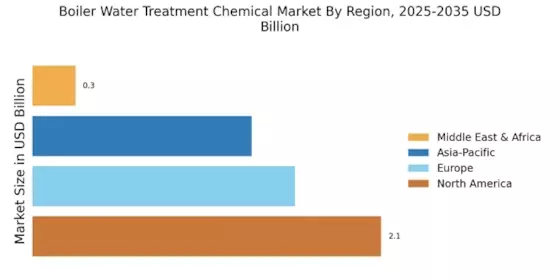

Rising Industrialization and Urbanization

The Boiler Water Treatment Chemical Market is poised for growth due to the rapid industrialization and urbanization trends observed in various regions. As industries expand and urban areas develop, the demand for steam and hot water generation increases, necessitating effective boiler water treatment solutions. The rise in manufacturing activities, particularly in sectors such as power generation, food processing, and pharmaceuticals, is expected to drive the consumption of boiler water treatment chemicals. Recent statistics suggest that industrial output is anticipated to rise by 5% annually, further propelling the need for efficient boiler operations. This scenario presents a favorable environment for the Boiler Water Treatment Chemical Market to thrive.

Technological Innovations in Water Treatment

The Boiler Water Treatment Chemical Market is benefiting from ongoing technological innovations that enhance the effectiveness and efficiency of water treatment processes. Advancements in chemical formulations, monitoring systems, and automation technologies are enabling industries to achieve better water quality and operational performance. For instance, the introduction of smart monitoring systems allows for real-time analysis of water quality, leading to timely interventions and optimized chemical usage. This trend is expected to drive the adoption of advanced boiler water treatment solutions, as industries seek to leverage technology for improved operational efficiency. The market is likely to see a rise in demand for innovative products that offer superior performance.

Growing Awareness of Maintenance and Reliability

The Boiler Water Treatment Chemical Market is experiencing growth due to the increasing awareness of the importance of maintenance and reliability in boiler operations. Industries are recognizing that effective water treatment is crucial for preventing scale formation, corrosion, and other issues that can lead to costly downtime and repairs. As a result, there is a heightened focus on implementing comprehensive maintenance programs that include the use of specialized boiler water treatment chemicals. Recent surveys indicate that companies are willing to invest in reliable solutions to ensure uninterrupted operations. This trend underscores the potential for the Boiler Water Treatment Chemical Market to expand as businesses prioritize long-term operational reliability.