Increasing Regulatory Compliance

The Chemical Sensors Market is also being driven by the increasing regulatory compliance requirements across various sectors. Governments and regulatory bodies are implementing stringent guidelines to monitor air and water quality, necessitating the use of chemical sensors for compliance. This trend is particularly evident in the environmental sector, where the demand for sensors that can detect pollutants and hazardous chemicals is on the rise. The market for environmental monitoring sensors is expected to grow significantly, with a projected CAGR of 6% from 2025 to 2030. This regulatory landscape is likely to create substantial opportunities for manufacturers of chemical sensors.

Growth in Automotive Applications

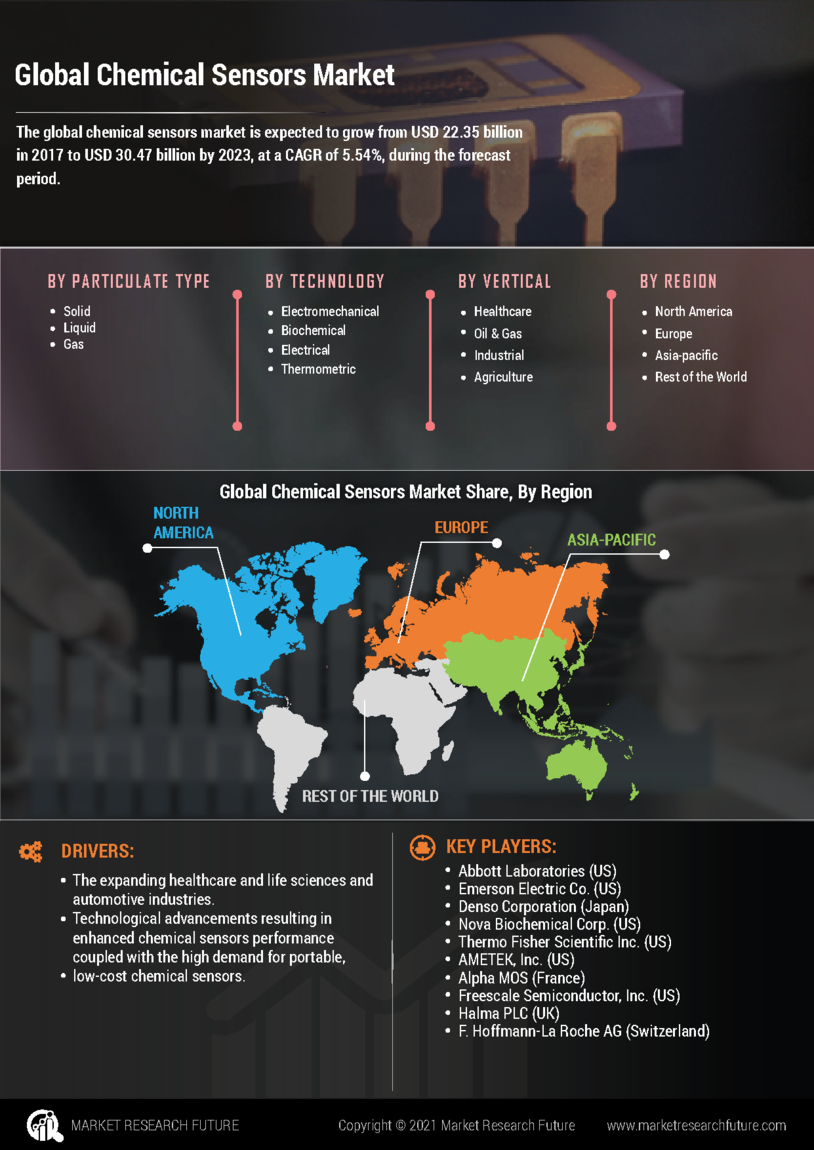

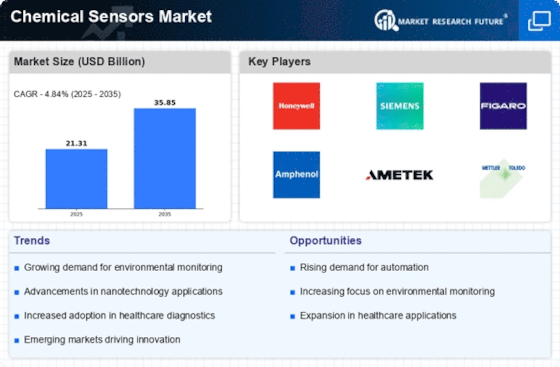

The automotive sector is witnessing a notable increase in the adoption of chemical sensors, which is likely to drive the Chemical Sensors Market significantly. With the rise of electric vehicles and stringent emission regulations, manufacturers are integrating advanced sensors to monitor air quality and emissions. The market for automotive chemical sensors is expected to reach USD 2 billion by 2026, reflecting a robust growth trajectory. This growth is indicative of the automotive industry's commitment to sustainability and innovation, as chemical sensors play a crucial role in enhancing vehicle performance and reducing environmental impact.

Expansion of Healthcare Applications

The expansion of healthcare applications is emerging as a vital driver for the Chemical Sensors Market. With the increasing focus on personalized medicine and point-of-care testing, chemical sensors are being utilized for various diagnostic applications. The market for medical chemical sensors is anticipated to grow at a CAGR of 9% over the next five years, reflecting the rising demand for rapid and accurate diagnostic tools. This growth is indicative of the healthcare sector's commitment to improving patient outcomes through innovative technologies, thereby creating a favorable environment for the proliferation of chemical sensors in medical applications.

Rising Demand for Safety and Security

The increasing emphasis on safety and security across various sectors appears to be a primary driver for the Chemical Sensors Market. Industries such as manufacturing, healthcare, and transportation are increasingly adopting chemical sensors to detect hazardous substances and ensure compliance with safety regulations. For instance, the market for chemical sensors in the industrial sector is projected to grow at a compound annual growth rate of approximately 7.5% from 2025 to 2030. This trend indicates a heightened awareness of the need for safety measures, which is likely to propel the demand for advanced chemical sensors that can provide real-time monitoring and alerts.

Technological Advancements in Sensor Design

Technological advancements in sensor design and materials are contributing to the evolution of the Chemical Sensors Market. Innovations such as miniaturization, improved sensitivity, and the development of smart sensors are enhancing the functionality and applicability of chemical sensors. For example, the introduction of nanomaterials in sensor fabrication has led to significant improvements in detection limits and response times. This trend is expected to drive market growth, as industries seek more efficient and reliable solutions for chemical detection. The market is projected to expand at a CAGR of 8% over the next five years, driven by these technological advancements.