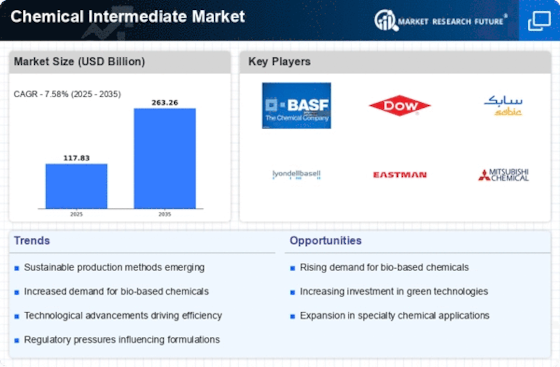

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Chemical Intermediate Market grow even more. Market participants are also undertaking various strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Chemical Intermediate industry must offer cost-effective items.

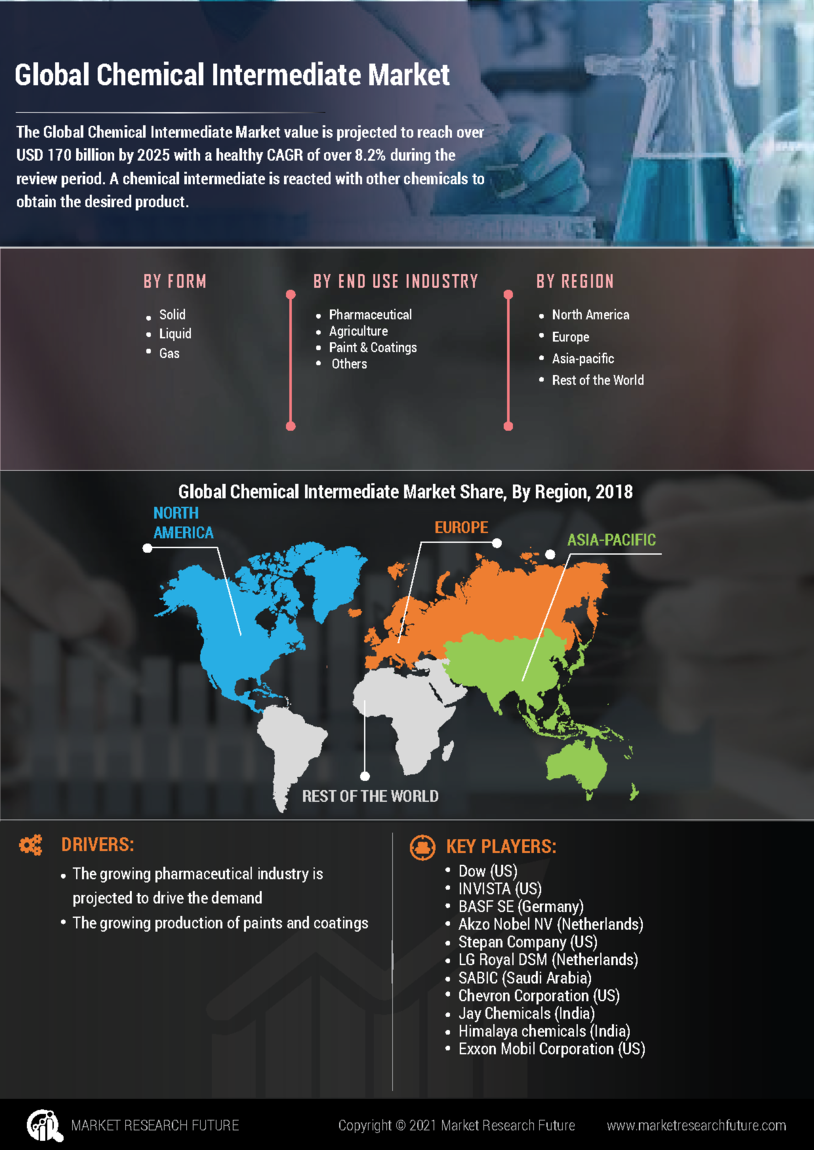

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers used in the global Chemical Intermediate industry to benefit clients and increase the market sector. In recent years, the Chemical Intermediate industry has offered some of the most significant advantages to the chemical industry. Major players in the Chemical Intermediate Market, including Deepak Nitrite Ltd., BASF SE, Rossari Biotech Ltd., INVISTA Nylon Chemical Co. Ltd., Stepan Company, LG Royal DSM, Chevron Corporation, Himalaya Chemicals, Akzo Nobel NV, and others, are attempting to increase market demand by investing in research and development operations.

BASF is the world's leading chemical company.

In March the company concluded its two-step capacity expansion for the intermediate chemical 1,4-butanediol (BD) by roughly 20 percent at its Verbund site in Geismar, Louisiana, while the first quarter of 2016. the investment raised the production capacity by implementing measures to fuel efficiency and enhanced infrastructure. With this expansion, BASF decided to strengthen its position in the market of South and North America and meet the growing chemical intermediate requirement of the customers from the local assets in Geismar.

Additionally, BASF invested in various products in North America, recently in formic acid, to spread the firm availability in the market and the commitment to the customers. BASF is a Tire-1 Company in the market of intermediate chemicals, and the expansion strategy of the company will boost the market growth.

Long-term access to QIRA® bio-based 1,4-butanediol (BDO) will be granted to BASF in 2023 by Qore® LLC (Qore), a joint venture between Cargill and HELM AG. To this end, BASF and Qore have reached a mutual understanding. At Cargill's biotechnology campus and corn refining facility in Eddyville, Iowa, Qore will manufacture the bio-based BDO. With QIRA, BASF will add bio-based versions of BDO derivatives, such as polytetramethylene ether glycol (polytetrahydrofuran, or PolyTHF) and tetrahydrofuran (THF), to its current portfolio. It is anticipated that the first commercial amounts will be accessible in Q1 2025.

AdvanSix, a diverse chemical firm, said today that three of its manufacturing locations—Frankford, Pennsylvania; Hopewell, Virginia; and Chesterfield, Virginia—have received certification to the International Sustainability and Carbon Certification (ISCC) PLUS level for 2024. An internationally renowned optional certification program for creating sustainable supply chains is called ISCC PLUS. The ISCC PLUS certification, which is confirmed by a

Deepak Nitrite Ltd., is a company of chemical manufacturer in India. Deepak Nitrite generates a wide range of chemicals, inclusive of colorant, agrochemicals, rubber, specialty, and fine chemicals, and pharmaceuticals.

In September an ambitious target to attain USD 1 billion in turnovers was set by intermediate chemicals major Deepak Nitrite in the next three to four years, along with its 1,400 crore rupees phenol-acetate facility at Petroleum, Chemicals And Petrochemicals Investment Region (PCPIR) in Dahej, Gujarat. The largest phenol-acetone plant is being set up by the company at Dahej PCPIR, with a capacity of about 200,000 tonnes per year.

Upon the commissioning of the project, it will create many new opportunities for India's intermediate chemical market.