Increased Pet Ownership

The rise in pet ownership appears to be a pivotal driver for the Pet Wearable Market. As more households welcome pets, the demand for innovative solutions to monitor and enhance pet well-being intensifies. Recent statistics indicate that approximately 70% of households own a pet, a figure that has steadily increased over the past decade. This growing pet population necessitates the development of wearables that cater to various needs, including health tracking and safety. The Pet Wearable Market is likely to benefit from this trend, as pet owners seek products that provide peace of mind and enhance the quality of life for their pets. Furthermore, the increasing emotional bond between pets and owners may lead to higher spending on pet-related technologies, thereby propelling the market forward.

Technological Advancements

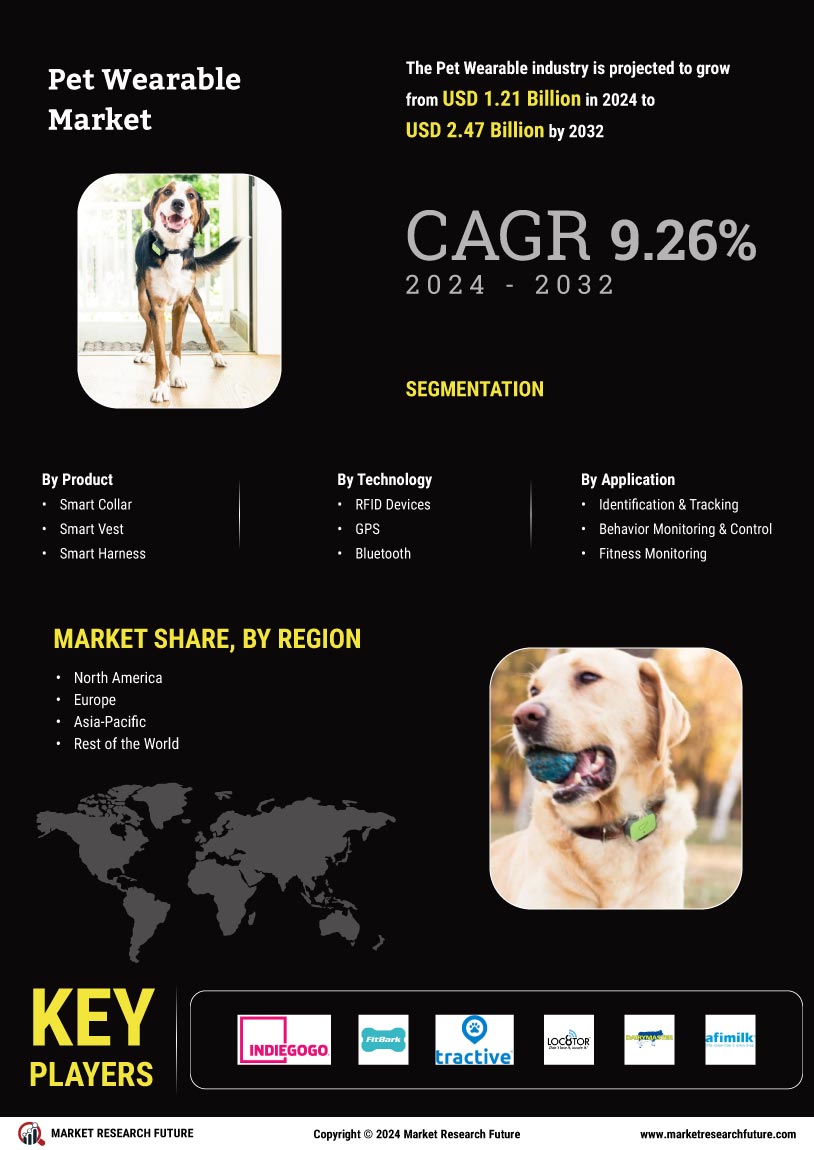

Technological advancements are transforming the Pet Wearable Market, enabling the development of sophisticated devices that offer enhanced functionalities. Innovations in GPS tracking, health monitoring, and activity tracking are becoming increasingly prevalent. For instance, the integration of artificial intelligence and machine learning into pet wearables allows for personalized insights into pet behavior and health. The market for pet wearables is projected to reach a valuation of over 2 billion dollars by 2026, driven by these technological innovations. As consumers become more tech-savvy, their expectations for pet wearables evolve, leading to a demand for products that not only track location but also provide health analytics. This trend suggests that companies in the Pet Wearable Market must continuously innovate to meet the changing needs of pet owners.

Safety and Security Concerns

Safety and security concerns are driving the Pet Wearable Market as pet owners seek solutions to protect their beloved companions. The increasing incidence of pet theft and loss has heightened awareness among pet owners, leading to a surge in demand for GPS-enabled wearables. Recent surveys indicate that nearly 40% of pet owners express concern about their pets' safety when outdoors. This concern is likely to propel the adoption of wearables that provide real-time location tracking and alerts. As the Pet Wearable Market continues to grow, companies that prioritize safety features in their products may find themselves well-positioned to meet the needs of anxious pet owners, thereby enhancing their market presence.

Growing Awareness of Pet Health

The growing awareness of pet health and wellness is a significant driver for the Pet Wearable Market. Pet owners are increasingly prioritizing their pets' health, leading to a surge in demand for wearables that monitor vital signs and activity levels. Research indicates that nearly 60% of pet owners are concerned about their pets' health, prompting them to seek solutions that provide real-time data on their pets' well-being. This heightened awareness is likely to drive the adoption of health-focused wearables, such as smart collars and fitness trackers. As the Pet Wearable Market evolves, companies that emphasize health monitoring features may find themselves at a competitive advantage, catering to the needs of health-conscious pet owners.

Customization and Personalization

Customization and personalization are emerging as key trends within the Pet Wearable Market. Pet owners increasingly seek products that reflect their pets' unique personalities and needs. This trend is evident in the growing demand for customizable wearables, such as collars and tags that can be tailored to individual preferences. Market data suggests that personalized pet products are gaining traction, with a notable increase in sales over the past few years. As consumers become more discerning, the ability to personalize pet wearables may enhance customer satisfaction and loyalty. Companies that offer customizable options are likely to capture a larger share of the Pet Wearable Market, as they cater to the desire for unique and meaningful products.