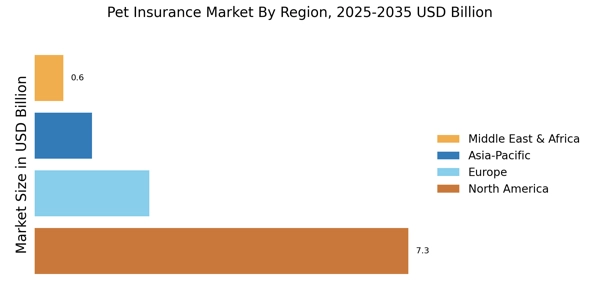

North America : Leading Market for Pet Insurance Market

North America is the largest market for pet insurance, accounting for approximately 65% of the global market share. The growth is driven by increasing pet ownership, rising veterinary costs, and a growing awareness of pet health insurance benefits. Regulatory support and favorable policies further enhance market dynamics, making it a robust environment for pet insurance providers. The U.S. is the primary contributor, followed by Canada, which holds about 15% of the market share. In North America, key players like Trupanion, Nationwide, and Healthy Paws dominate the landscape, offering a variety of plans tailored to pet owners' needs. The competitive environment is characterized by innovation in policy offerings and customer service enhancements. The presence of established companies ensures a high level of trust among consumers, contributing to the market's sustained growth. The trend towards digital platforms for policy management is also gaining traction, further enhancing customer engagement.

Europe : Emerging Market with Growth Potential

Europe is witnessing significant growth in the pet insurance market, currently holding about 20% of the global share. The increasing trend of pet ownership, coupled with rising awareness of pet health, is driving demand. Regulatory frameworks in countries like the UK and Germany are evolving to support the industry, fostering a conducive environment for growth. The market is expected to expand as more pet owners recognize the financial benefits of insurance. Leading countries in Europe include the UK, Germany, and France, where major players like Petplan and other local insurers are making strides. The competitive landscape is marked by a mix of established companies and new entrants, all vying for market share. The focus on customer-centric services and innovative policy options is shaping the market, with a notable increase in digital solutions for policy management. The European market is poised for further expansion as consumer awareness continues to grow.

Asia-Pacific : Rapidly Growing Pet Insurance Market Sector

The Asia-Pacific region is emerging as a significant player in the pet insurance market, currently holding about 10% of the global share. The growth is fueled by increasing disposable incomes, urbanization, and a rising trend of pet ownership. Countries like Japan and Australia are leading the market, with regulatory frameworks gradually adapting to support the insurance sector. The demand for pet insurance is expected to rise as awareness of pet health issues increases among consumers. In this region, key players include local insurers and international companies expanding their footprint. The competitive landscape is evolving, with a focus on tailored insurance products that cater to the unique needs of pet owners. The presence of digital platforms for policy management is also gaining traction, enhancing customer experience and engagement. As the market matures, innovative solutions and customer-centric approaches will be crucial for sustained growth.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa region is an emerging market for pet insurance, currently holding about 5% of the global share. The growth is driven by increasing pet ownership, urbanization, and a growing awareness of the importance of pet health. Regulatory frameworks are still developing, but there is a noticeable shift towards supporting the pet insurance sector. As more consumers recognize the benefits of insurance, the market is expected to expand significantly in the coming years. Leading countries in this region include South Africa and the UAE, where the presence of key players is gradually increasing. The competitive landscape is characterized by a mix of local and international insurers, all aiming to capture the growing demand. The focus on customer education and tailored insurance products is essential for market penetration. As the region continues to develop, innovative solutions and strategic partnerships will play a vital role in shaping the future of pet insurance.