Growing Pet Ownership

The rise in pet ownership across the United States significantly influences the pet insurance market. Recent statistics suggest that approximately 70% of households own a pet, a figure that has steadily increased over the past decade. This growing demographic of pet owners is more inclined to consider insurance as a means of safeguarding their pets' health. The pet insurance market is likely to benefit from this trend, as new pet owners often seek to provide the best care possible for their animals. Additionally, the emotional bond between pets and their owners fosters a willingness to invest in insurance, as many view their pets as family members. This cultural shift towards viewing pets as integral parts of the household is expected to continue, thereby enhancing the demand for pet insurance products.

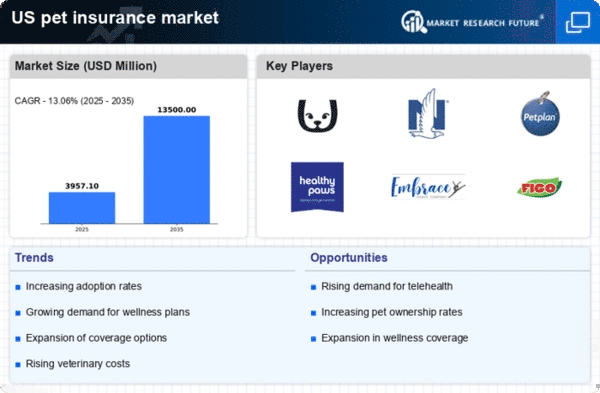

Rising Veterinary Costs

The escalating costs associated with veterinary care are a primary driver for the pet insurance market. In recent years, the average cost of veterinary services has surged, with some estimates indicating an increase of over 30% in certain procedures. This trend compels pet owners to seek financial protection through insurance, as unexpected medical expenses can be burdensome. The pet insurance market is responding to this demand by offering various plans that cover a range of treatments, from routine check-ups to emergency surgeries. As pet owners become more aware of the potential financial implications of pet healthcare, the inclination to invest in insurance grows, thereby expanding the market. Furthermore, the increasing prevalence of chronic conditions in pets necessitates comprehensive coverage, further driving the need for insurance solutions.

Increased Awareness of Pet Health

There is a notable increase in awareness regarding pet health and wellness, which serves as a catalyst for the pet insurance market. Pet owners are becoming more informed about the importance of preventive care and regular veterinary visits. This heightened awareness is reflected in the growing number of pet health campaigns and educational resources available to the public. As a result, pet owners are more likely to seek insurance to cover routine check-ups and preventive treatments, which can ultimately lead to healthier pets. The pet insurance market is adapting to this trend by offering plans that emphasize preventive care, thus appealing to health-conscious pet owners. This shift in focus not only enhances the value proposition of insurance but also encourages a proactive approach to pet healthcare.

Technological Advancements in Pet Care

Technological advancements in pet care are reshaping the landscape of the pet insurance market. Innovations such as telemedicine and wearable health devices for pets are becoming increasingly prevalent. These technologies enable pet owners to monitor their pets' health more effectively and seek timely veterinary care. The pet insurance market is likely to capitalize on these advancements by integrating technology into their offerings, such as providing telehealth consultations as part of insurance plans. This integration not only enhances the customer experience but also encourages pet owners to utilize their insurance more frequently. As technology continues to evolve, it may lead to more tailored insurance products that align with the needs of tech-savvy pet owners, thereby expanding the market.

Legislative Changes Favoring Pet Insurance

Recent legislative changes in the United States are creating a more favorable environment for the pet insurance market. New regulations aimed at increasing transparency in the insurance industry are likely to enhance consumer trust and encourage more pet owners to consider insurance options. Additionally, some states are exploring initiatives to promote pet health insurance as a means of reducing the financial burden on pet owners. The pet insurance market stands to benefit from these developments, as increased regulation may lead to a more competitive landscape, ultimately resulting in better coverage options for consumers. As awareness of these legislative changes grows, pet owners may be more inclined to invest in insurance, further propelling market growth.