Increasing Energy Demand

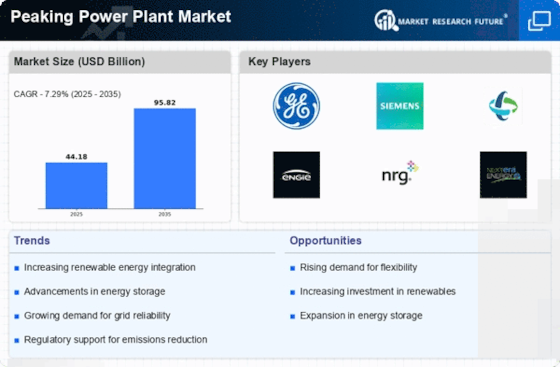

The Peaking Power Plant Market is experiencing a notable surge in energy demand, driven by urbanization and industrial growth. As populations expand and economies develop, the need for reliable electricity supply intensifies. According to recent data, energy consumption is projected to rise by approximately 2.5% annually over the next decade. This increasing demand necessitates the establishment of peaking power plants, which can quickly respond to fluctuations in energy needs. These facilities are essential for maintaining grid stability, particularly during peak usage hours. Consequently, the Peaking Power Plant Market is likely to see substantial investments aimed at expanding capacity and enhancing operational efficiency to meet this growing demand.

Government Incentives and Policies

Government incentives and policies play a crucial role in shaping the Peaking Power Plant Market. Many governments are implementing supportive frameworks to encourage the development of peaking power plants, particularly in regions facing energy shortages. These policies often include tax credits, grants, and favorable regulatory conditions that facilitate investment in new infrastructure. For instance, certain jurisdictions have established mandates for renewable energy integration, which indirectly boosts the demand for peaking power plants to ensure grid reliability. As a result, the Peaking Power Plant Market is likely to benefit from these initiatives, fostering an environment conducive to growth and innovation.

Integration of Energy Storage Solutions

The integration of energy storage solutions is becoming increasingly pivotal within the Peaking Power Plant Market. As renewable energy sources, such as solar and wind, gain traction, the need for effective energy storage systems to manage intermittency becomes apparent. Energy storage technologies, including batteries and pumped hydro storage, can complement peaking power plants by providing backup power during peak demand periods. This synergy not only enhances grid reliability but also optimizes the utilization of renewable resources. The market for energy storage is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This trend indicates a robust opportunity for the Peaking Power Plant Market to evolve and adapt to changing energy landscapes.

Technological Innovations in Power Generation

Technological innovations are significantly influencing the Peaking Power Plant Market. Advances in power generation technologies, such as combined cycle gas turbines and advanced control systems, are enhancing the efficiency and responsiveness of peaking power plants. These innovations allow for quicker ramp-up times and improved fuel efficiency, which are essential for meeting peak demand effectively. Furthermore, the adoption of digital technologies, including artificial intelligence and machine learning, is optimizing operational performance and predictive maintenance. As these technologies continue to evolve, the Peaking Power Plant Market is expected to witness increased competitiveness and reduced operational costs, thereby attracting further investment.

Environmental Regulations and Sustainability Goals

Environmental regulations and sustainability goals are increasingly shaping the Peaking Power Plant Market. As concerns about climate change intensify, regulatory bodies are imposing stricter emissions standards on power generation facilities. This trend compels peaking power plants to adopt cleaner technologies and practices to comply with environmental mandates. Additionally, many countries are setting ambitious targets for reducing greenhouse gas emissions, which may influence the design and operation of peaking power plants. The market is likely to see a shift towards more sustainable practices, including the integration of low-emission technologies and renewable energy sources. This evolution not only aligns with regulatory requirements but also enhances the public perception of the Peaking Power Plant Market.