Rising Energy Demand

The Nuclear Power Plant Equipment Market is experiencing a surge in demand due to the increasing global energy requirements. As populations grow and economies expand, the need for reliable and efficient energy sources becomes paramount. Nuclear power, known for its ability to generate large amounts of electricity with minimal greenhouse gas emissions, is positioned as a viable solution. According to recent data, nuclear energy contributes approximately 10% of the world's electricity supply, highlighting its critical role in meeting energy needs. This rising demand for energy is likely to drive investments in nuclear power infrastructure, thereby boosting the Nuclear Power Plant Equipment Market.

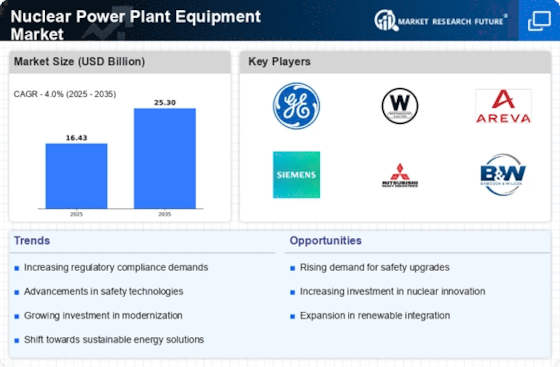

Investment in Modernization and Upgrades

The Nuclear Power Plant Equipment Market is witnessing a trend towards modernization and upgrades of existing facilities. Many aging nuclear plants require significant investments to enhance safety, efficiency, and operational lifespan. This modernization effort often involves the integration of advanced technologies and equipment, which can lead to improved performance and reduced operational costs. Data indicates that The Nuclear Power Plant Equipment Market is projected to grow significantly, with investments reaching billions of dollars over the next decade. Such investments are crucial for maintaining the competitiveness of nuclear energy in the broader energy landscape, thereby driving the Nuclear Power Plant Equipment Market.

Regulatory Support and Policy Frameworks

The Nuclear Power Plant Equipment Market benefits from supportive regulatory environments and policy frameworks that encourage the development of nuclear energy. Governments are increasingly recognizing the importance of nuclear power in achieving energy security and reducing carbon emissions. For instance, several countries have implemented policies that facilitate the construction of new nuclear plants and the upgrading of existing facilities. This regulatory support not only enhances investor confidence but also stimulates technological advancements within the Nuclear Power Plant Equipment Market. As nations strive to meet climate goals, the favorable policy landscape is expected to propel market growth.

Global Shift Towards Low-Carbon Energy Sources

The Nuclear Power Plant Equipment Market is significantly influenced by the global shift towards low-carbon energy sources. As countries commit to reducing their carbon footprints, nuclear energy emerges as a key player in the transition to sustainable energy systems. The International Energy Agency has indicated that nuclear power could play a crucial role in achieving net-zero emissions targets by 2050. This shift not only enhances the attractiveness of nuclear energy but also drives demand for advanced equipment and technologies within the Nuclear Power Plant Equipment Market. The increasing emphasis on low-carbon solutions is expected to sustain market growth in the coming years.

Technological Innovations in Safety and Efficiency

Technological innovations play a pivotal role in shaping the Nuclear Power Plant Equipment Market. Advances in safety systems, reactor designs, and operational efficiencies are transforming the landscape of nuclear energy. Innovations such as small modular reactors (SMRs) and digital instrumentation are enhancing the safety and reliability of nuclear power plants. These technologies not only address public concerns regarding safety but also improve the overall efficiency of energy production. As these innovations gain traction, they are likely to attract further investments and interest in the Nuclear Power Plant Equipment Market, fostering growth and development.